Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Restaurant Brands International Inc (NYSE:QSR) in this article.

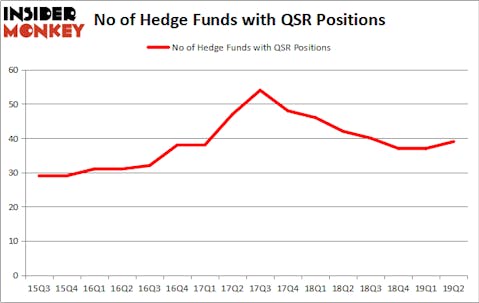

Is Restaurant Brands International Inc (NYSE:QSR) ready to rally soon? Prominent investors are buying. The number of bullish hedge fund positions moved up by 2 recently. Our calculations also showed that QSR isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the new hedge fund action encompassing Restaurant Brands International Inc (NYSE:QSR).

What does smart money think about Restaurant Brands International Inc (NYSE:QSR)?

At Q2’s end, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from the first quarter of 2019. On the other hand, there were a total of 42 hedge funds with a bullish position in QSR a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Restaurant Brands International Inc (NYSE:QSR) was held by Pershing Square, which reported holding $1087.7 million worth of stock at the end of March. It was followed by Berkshire Hathaway with a $586.8 million position. Other investors bullish on the company included Steadfast Capital Management, Suvretta Capital Management, and Melvin Capital Management.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Palestra Capital Management, managed by Andrew Immerman and Jeremy Schiffman, assembled the most valuable position in Restaurant Brands International Inc (NYSE:QSR). Palestra Capital Management had $67.6 million invested in the company at the end of the quarter. James Parsons’s Junto Capital Management also initiated a $59.7 million position during the quarter. The other funds with new positions in the stock are Ryan Caldwell’s Chiron Investment Management, Steven Boyd’s Armistice Capital, and Principal Global Investors’s Columbus Circle Investors.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Restaurant Brands International Inc (NYSE:QSR) but similarly valued. These stocks are Franklin Resources, Inc. (NYSE:BEN), ResMed Inc. (NYSE:RMD), Plains All American Pipeline, L.P. (NYSE:PAA), and ArcelorMittal (NYSE:MT). This group of stocks’ market caps match QSR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BEN | 25 | 636749 | -3 |

| RMD | 10 | 102957 | -8 |

| PAA | 11 | 79838 | 3 |

| MT | 15 | 247433 | 3 |

| Average | 15.25 | 266744 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $267 million. That figure was $3041 million in QSR’s case. Franklin Resources, Inc. (NYSE:BEN) is the most popular stock in this table. On the other hand ResMed Inc. (NYSE:RMD) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Restaurant Brands International Inc (NYSE:QSR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on QSR, though not to the same extent, as the stock returned 3% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.