Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published this article and predicted that US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. Insider Monkey finished processing 835 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2019. What do these smart investors think about General Dynamics Corporation (NYSE:GD)?

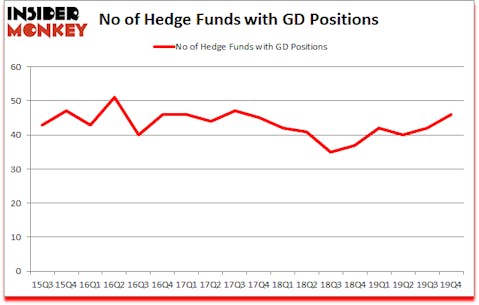

General Dynamics Corporation (NYSE:GD) has experienced an increase in activity from the world’s largest hedge funds lately. GD was in 46 hedge funds’ portfolios at the end of the fourth quarter of 2019. There were 42 hedge funds in our database with GD holdings at the end of the previous quarter. Our calculations also showed that GD isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are tons of gauges stock traders use to evaluate their holdings. A couple of the less utilized gauges are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the best picks of the top hedge fund managers can outperform the broader indices by a very impressive amount (see the details here).

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. With all of this in mind we’re going to take a look at the recent hedge fund action regarding General Dynamics Corporation (NYSE:GD).

How have hedgies been trading General Dynamics Corporation (NYSE:GD)?

At the end of the fourth quarter, a total of 46 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from the third quarter of 2019. On the other hand, there were a total of 37 hedge funds with a bullish position in GD a year ago. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

More specifically, Longview Asset Management was the largest shareholder of General Dynamics Corporation (NYSE:GD), with a stake worth $5765 million reported as of the end of September. Trailing Longview Asset Management was Farallon Capital, which amassed a stake valued at $173.1 million. AQR Capital Management, Millennium Management, and Adage Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Longview Asset Management allocated the biggest weight to General Dynamics Corporation (NYSE:GD), around 93.85% of its 13F portfolio. Impala Asset Management is also relatively very bullish on the stock, designating 4.36 percent of its 13F equity portfolio to GD.

Now, specific money managers were breaking ground themselves. Renaissance Technologies, assembled the most valuable position in General Dynamics Corporation (NYSE:GD). Renaissance Technologies had $64.1 million invested in the company at the end of the quarter. Lee Ainslie’s Maverick Capital also initiated a $5.1 million position during the quarter. The other funds with brand new GD positions are Matthew Hulsizer’s PEAK6 Capital Management, Matthew L Pinz’s Pinz Capital, and Peter Muller’s PDT Partners.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as General Dynamics Corporation (NYSE:GD) but similarly valued. We will take a look at Sumitomo Mitsui Financial Grp, Inc. (NYSE:SMFG), Uber Technologies, Inc. (NYSE:UBER), Norfolk Southern Corp. (NYSE:NSC), and Suncor Energy Inc. (NYSE:SU). This group of stocks’ market caps resemble GD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SMFG | 11 | 584035 | 0 |

| UBER | 94 | 6677417 | 46 |

| NSC | 52 | 1931031 | 2 |

| SU | 39 | 1487356 | -2 |

| Average | 49 | 2669960 | 11.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 49 hedge funds with bullish positions and the average amount invested in these stocks was $2670 million. That figure was $6699 million in GD’s case. Uber Technologies, Inc. (NYSE:UBER) is the most popular stock in this table. On the other hand Sumitomo Mitsui Financial Grp, Inc. (NYSE:SMFG) is the least popular one with only 11 bullish hedge fund positions. General Dynamics Corporation (NYSE:GD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 12.9% in 2020 through March 9th but beat the market by 1.9 percentage points. A small number of hedge funds were also right about betting on GD, though not to the same extent, as the stock returned -14.5% during the same time period and outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.