The financial regulations require hedge funds and wealthy investors that crossed the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on June 28th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Qorvo Inc (NASDAQ:QRVO) based on those filings.

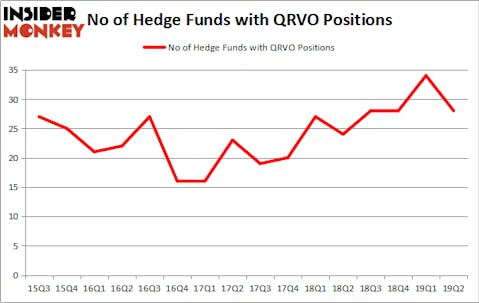

Qorvo Inc (NASDAQ:QRVO) shareholders have witnessed a decrease in activity from the world’s largest hedge funds lately. Our calculations also showed that QRVO isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to review the latest hedge fund action encompassing Qorvo Inc (NASDAQ:QRVO).

What have hedge funds been doing with Qorvo Inc (NASDAQ:QRVO)?

At Q2’s end, a total of 28 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -18% from the first quarter of 2019. On the other hand, there were a total of 24 hedge funds with a bullish position in QRVO a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Seth Klarman’s Baupost Group has the number one position in Qorvo Inc (NASDAQ:QRVO), worth close to $578.3 million, corresponding to 5.2% of its total 13F portfolio. Sitting at the No. 2 spot is Soroban Capital Partners, led by Eric W. Mandelblatt and Gaurav Kapadia, holding a $196.7 million position; 3% of its 13F portfolio is allocated to the company. Other members of the smart money with similar optimism encompass David Cohen and Harold Levy’s Iridian Asset Management, Ken Fisher’s Fisher Asset Management and Cliff Asness’s AQR Capital Management.

Judging by the fact that Qorvo Inc (NASDAQ:QRVO) has witnessed declining sentiment from the aggregate hedge fund industry, it’s easy to see that there were a few funds who sold off their positions entirely by the end of the second quarter. Intriguingly, Leon Shaulov’s Maplelane Capital sold off the biggest position of the “upper crust” of funds followed by Insider Monkey, comprising an estimated $12.2 million in stock. John Hurley’s fund, Cavalry Asset Management, also dropped its stock, about $9.1 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 6 funds by the end of the second quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Qorvo Inc (NASDAQ:QRVO) but similarly valued. We will take a look at IPG Photonics Corporation (NASDAQ:IPGP), Zions Bancorporation, National Association (NASDAQ:ZION), Jazz Pharmaceuticals Public Limited Company (NASDAQ:JAZZ), and Teradyne, Inc. (NYSE:TER). This group of stocks’ market valuations are closest to QRVO’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IPGP | 16 | 142417 | 3 |

| ZION | 35 | 544360 | -9 |

| JAZZ | 20 | 744942 | -7 |

| TER | 27 | 684058 | 3 |

| Average | 24.5 | 528944 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.5 hedge funds with bullish positions and the average amount invested in these stocks was $529 million. That figure was $1181 million in QRVO’s case. Zions Bancorporation, National Association (NASDAQ:ZION) is the most popular stock in this table. On the other hand IPG Photonics Corporation (NASDAQ:IPGP) is the least popular one with only 16 bullish hedge fund positions. Qorvo Inc (NASDAQ:QRVO) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on QRVO as the stock returned 11.3% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.