Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of June. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Alder Biopharmaceuticals Inc (NASDAQ:ALDR), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

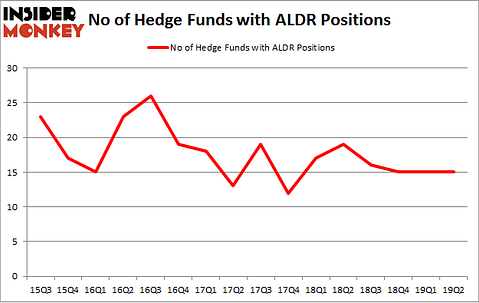

Hedge fund interest in Alder Biopharmaceuticals Inc (NASDAQ:ALDR) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare ALDR to other stocks including Theravance Biopharma Inc (NASDAQ:TBPH), Controladora Vuela Compania de Aviacion, S.A.B. de C.V. (NYSE:VLRS), and Bain Capital Specialty Finance, Inc. (NYSE:BCSF) to get a better sense of its popularity. Our calculations also showed that ALDR isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s check out the new hedge fund action regarding Alder Biopharmaceuticals Inc (NASDAQ:ALDR).

How have hedgies been trading Alder Biopharmaceuticals Inc (NASDAQ:ALDR)?

At the end of the second quarter, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. By comparison, 19 hedge funds held shares or bullish call options in ALDR a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Redmile Group, managed by Jeremy Green, holds the most valuable position in Alder Biopharmaceuticals Inc (NASDAQ:ALDR). Redmile Group has a $97 million position in the stock, comprising 2.7% of its 13F portfolio. Coming in second is Samlyn Capital, led by Robert Pohly, holding a $41.4 million position; the fund has 0.9% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions encompass Ken Griffin’s Citadel Investment Group, Jim Tananbaum’s Foresite Capital and William Leland Edwards’s Palo Alto Investors.

Due to the fact that Alder Biopharmaceuticals Inc (NASDAQ:ALDR) has faced falling interest from hedge fund managers, we can see that there lies a certain “tier” of hedgies that slashed their positions entirely heading into Q3. Intriguingly, Christopher James’s Partner Fund Management dumped the biggest stake of the 750 funds monitored by Insider Monkey, valued at close to $31.5 million in stock, and Christopher James’s Partner Fund Management was right behind this move, as the fund dropped about $16.5 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Alder Biopharmaceuticals Inc (NASDAQ:ALDR). These stocks are Theravance Biopharma Inc (NASDAQ:TBPH), Controladora Vuela Compania de Aviacion, S.A.B. de C.V. (NYSE:VLRS), Bain Capital Specialty Finance, Inc. (NYSE:BCSF), and Twist Bioscience Corporation (NASDAQ:TWST). This group of stocks’ market valuations resemble ALDR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TBPH | 8 | 362299 | -1 |

| VLRS | 7 | 105923 | -3 |

| BCSF | 5 | 32152 | 3 |

| TWST | 9 | 70227 | 6 |

| Average | 7.25 | 142650 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.25 hedge funds with bullish positions and the average amount invested in these stocks was $143 million. That figure was $297 million in ALDR’s case. Twist Bioscience Corporation (NASDAQ:TWST) is the most popular stock in this table. On the other hand Bain Capital Specialty Finance, Inc. (NYSE:BCSF) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Alder Biopharmaceuticals Inc (NASDAQ:ALDR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on ALDR as the stock returned 60.2% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.