At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Hedge fund interest in Global Blood Therapeutics Inc (NASDAQ:GBT) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Companhia Paranaense de Energia – COPEL (NYSE:ELP), KBR, Inc. (NYSE:KBR), and PotlatchDeltic Corporation (NASDAQ:PCH) to gather more data points.

In the financial world there are a lot of formulas shareholders can use to appraise their holdings. A pair of the less known formulas are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the elite money managers can outperform their index-focused peers by a significant amount (see the details here).

Let’s view the key hedge fund action encompassing Global Blood Therapeutics Inc (NASDAQ:GBT).

What have hedge funds been doing with Global Blood Therapeutics Inc (NASDAQ:GBT)?

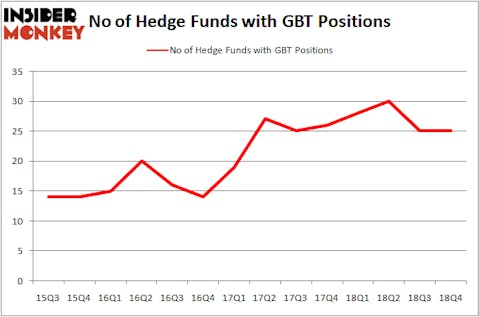

At Q4’s end, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. By comparison, 28 hedge funds held shares or bullish call options in GBT a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were adding to their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Joseph Edelman’s Perceptive Advisors has the largest position in Global Blood Therapeutics Inc (NASDAQ:GBT), worth close to $222.7 million, amounting to 8.5% of its total 13F portfolio. On Perceptive Advisors’s heels is Stephen DuBois of Camber Capital Management, with a $92.4 million position; the fund has 4.4% of its 13F portfolio invested in the stock. Other professional money managers that are bullish contain Farallon Capital, Jeffrey Jay and David Kroin’s Great Point Partners and Eli Casdin’s Casdin Capital.

Because Global Blood Therapeutics Inc (NASDAQ:GBT) has experienced falling interest from hedge fund managers, logic holds that there were a few hedge funds that slashed their entire stakes last quarter. Intriguingly, Zach Schreiber’s Point State Capital said goodbye to the biggest stake of the “upper crust” of funds tracked by Insider Monkey, totaling close to $20.8 million in call options. Israel Englander’s fund, Millennium Management, also said goodbye to its call options, about $14.9 million worth. These transactions are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Global Blood Therapeutics Inc (NASDAQ:GBT). These stocks are Companhia Paranaense de Energia – COPEL (NYSE:ELP), KBR, Inc. (NYSE:KBR), PotlatchDeltic Corporation (NASDAQ:PCH), and The Michaels Companies, Inc. (NASDAQ:MIK). This group of stocks’ market caps are similar to GBT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ELP | 8 | 34642 | 0 |

| KBR | 26 | 345110 | 7 |

| PCH | 15 | 279786 | -1 |

| MIK | 30 | 255528 | 4 |

| Average | 19.75 | 228767 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $229 million. That figure was $545 million in GBT’s case. The Michaels Companies, Inc. (NASDAQ:MIK) is the most popular stock in this table. On the other hand Companhia Paranaense de Energia – COPEL (NYSE:ELP) is the least popular one with only 8 bullish hedge fund positions. Global Blood Therapeutics Inc (NASDAQ:GBT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on GBT as the stock returned 31.5% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.