It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 20 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated an outperformance of 4 percentage points during the first 9 months of 2019. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Cimpress NV (NASDAQ:CMPR).

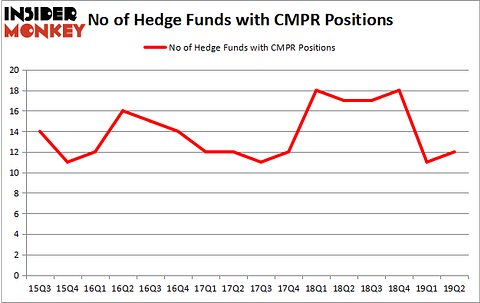

Cimpress NV (NASDAQ:CMPR) was in 12 hedge funds’ portfolios at the end of the second quarter of 2019. CMPR investors should be aware of an increase in enthusiasm from smart money in recent months. There were 11 hedge funds in our database with CMPR positions at the end of the previous quarter. Our calculations also showed that CMPR isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are dozens of gauges shareholders can use to evaluate stocks. Two of the less utilized gauges are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the best hedge fund managers can outpace the broader indices by a healthy margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to view the key hedge fund action regarding Cimpress NV (NASDAQ:CMPR).

Hedge fund activity in Cimpress NV (NASDAQ:CMPR)

At Q2’s end, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of 9% from the previous quarter. On the other hand, there were a total of 17 hedge funds with a bullish position in CMPR a year ago. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

The largest stake in Cimpress NV (NASDAQ:CMPR) was held by Spruce House Investment Management, which reported holding $214.4 million worth of stock at the end of March. It was followed by Arlington Value Capital with a $195.4 million position. Other investors bullish on the company included Bares Capital Management, D E Shaw, and Diamond Hill Capital.

Consequently, specific money managers were breaking ground themselves. GLG Partners, managed by Noam Gottesman, established the most outsized position in Cimpress NV (NASDAQ:CMPR). GLG Partners had $1.9 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also initiated a $0.4 million position during the quarter. The only other fund with a new position in the stock is Jonathan Soros’s JS Capital.

Let’s go over hedge fund activity in other stocks similar to Cimpress NV (NASDAQ:CMPR). We will take a look at Dana Incorporated (NYSE:DAN), Rapid7 Inc (NASDAQ:RPD), TopBuild Corp (NYSE:BLD), and American Assets Trust, Inc (NYSE:AAT). This group of stocks’ market valuations match CMPR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DAN | 25 | 363492 | -2 |

| RPD | 25 | 386339 | -2 |

| BLD | 14 | 112473 | -3 |

| AAT | 15 | 127744 | 1 |

| Average | 19.75 | 247512 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $248 million. That figure was $496 million in CMPR’s case. Dana Incorporated (NYSE:DAN) is the most popular stock in this table. On the other hand TopBuild Corp (NYSE:BLD) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Cimpress NV (NASDAQ:CMPR) is even less popular than BLD. Hedge funds clearly dropped the ball on CMPR as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on CMPR as the stock returned 45.1% during the third quarter and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.