At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

Hedge fund interest in Buckeye Partners, L.P. (NYSE:BPL) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as LivaNova PLC (NASDAQ:LIVN), First Citizens BancShares Inc. (NASDAQ:FCNCA), and First Solar, Inc. (NASDAQ:FSLR) to gather more data points.

In today’s marketplace there are tons of gauges shareholders employ to value their holdings. A duo of the less utilized gauges are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the best money managers can outclass their index-focused peers by a significant amount (see the details here).

Let’s take a gander at the recent hedge fund action regarding Buckeye Partners, L.P. (NYSE:BPL).

How have hedgies been trading Buckeye Partners, L.P. (NYSE:BPL)?

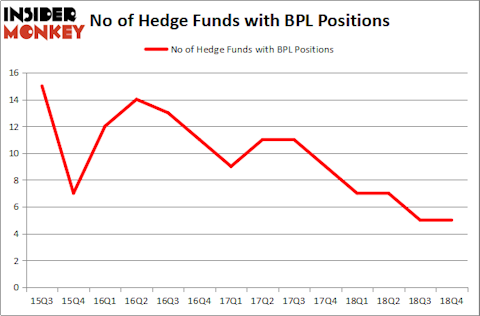

At Q4’s end, a total of 5 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards BPL over the last 14 quarters. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Perella Weinberg Partners, managed by Daniel Arbess, holds the number one position in Buckeye Partners, L.P. (NYSE:BPL). Perella Weinberg Partners has a $3.5 million position in the stock, comprising 0.2% of its 13F portfolio. On Perella Weinberg Partners’s heels is Citadel Investment Group, led by Ken Griffin, holding a $1.4 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism contain T Boone Pickens’s BP Capital, and David Andre and Astro Teller’s Cerebellum Capital.

Due to the fact that Buckeye Partners, L.P. (NYSE:BPL) has experienced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there was a specific group of money managers that decided to sell off their positions entirely by the end of the third quarter. At the top of the heap, Israel Englander’s Millennium Management sold off the biggest stake of all the hedgies followed by Insider Monkey, comprising about $2.4 million in stock, and Kelly Hampaul’s Everett Capital Advisors was right behind this move, as the fund dumped about $1.9 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks similar to Buckeye Partners, L.P. (NYSE:BPL). We will take a look at LivaNova PLC (NASDAQ:LIVN), First Citizens BancShares Inc. (NASDAQ:FCNCA), First Solar, Inc. (NASDAQ:FSLR), and GCI Liberty, Inc. (NASDAQ:GLIBA). This group of stocks’ market caps match BPL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LIVN | 22 | 375931 | -8 |

| FCNCA | 22 | 205273 | 3 |

| FSLR | 22 | 352890 | 8 |

| GLIBA | 37 | 1382128 | 1 |

| Average | 25.75 | 579056 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $579 million. That figure was $6 million in BPL’s case. GCI Liberty, Inc. (NASDAQ:GLIBA) is the most popular stock in this table. On the other hand LivaNova PLC (NASDAQ:LIVN) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Buckeye Partners, L.P. (NYSE:BPL) is even less popular than LIVN. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on BPL, though not to the same extent, as the stock returned 18.7% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.