The government requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30. We at Insider Monkey have made an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Buckeye Partners, L.P. (NYSE:BPL) based on those filings.

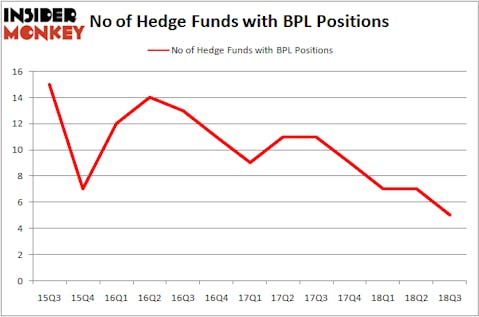

Buckeye Partners, L.P. (NYSE:BPL) has seen a decrease in support from the world’s most elite money managers recently. Our calculations also showed that BPL isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are a lot of indicators shareholders have at their disposal to analyze stocks. A duo of the most underrated indicators are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the elite hedge fund managers can outclass the broader indices by a very impressive margin (see the details here).

Let’s check out the new hedge fund action surrounding Buckeye Partners, L.P. (NYSE:BPL).

How have hedgies been trading Buckeye Partners, L.P. (NYSE:BPL)?

Heading into the fourth quarter of 2018, a total of 5 of the hedge funds tracked by Insider Monkey were long this stock, a change of -29% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards BPL over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

The largest stake in Buckeye Partners, L.P. (NYSE:BPL) was held by Citadel Investment Group, which reported holding $5.8 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $4.8 million position. Other investors bullish on the company included PEAK6 Capital Management, Millennium Management, and Everett Capital Advisors.

Since Buckeye Partners, L.P. (NYSE:BPL) has witnessed falling interest from the smart money, it’s easy to see that there is a sect of money managers who were dropping their full holdings heading into Q3. At the top of the heap, Jim Simons’s Renaissance Technologies dumped the biggest position of all the hedgies monitored by Insider Monkey, valued at an estimated $11.1 million in stock, and Stuart J. Zimmer’s Zimmer Partners was right behind this move, as the fund dumped about $2.4 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 2 funds heading into Q3.

Let’s check out hedge fund activity in other stocks similar to Buckeye Partners, L.P. (NYSE:BPL). These stocks are Genesee & Wyoming Inc (NYSE:GWR), Brookfield Renewable Partners L.P. (NYSE:BEP), Proofpoint Inc (NASDAQ:PFPT), and Grand Canyon Education Inc (NASDAQ:LOPE). This group of stocks’ market valuations resemble BPL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GWR | 11 | 325312 | -4 |

| BEP | 2 | 7451 | 0 |

| PFPT | 25 | 421514 | -4 |

| LOPE | 24 | 299991 | 0 |

| Average | 15.5 | 263567 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $264 million. That figure was $10 million in BPL’s case. Proofpoint Inc (NASDAQ:PFPT) is the most popular stock in this table. On the other hand Brookfield Renewable Partners L.P. (NYSE:BEP) is the least popular one with only 2 bullish hedge fund positions. Buckeye Partners, L.P. (NYSE:BPL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard PFPT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.