Insider Monkey has processed numerous 13F filings of hedge funds and successful investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of AutoNation, Inc. (NYSE:AN) based on that data.

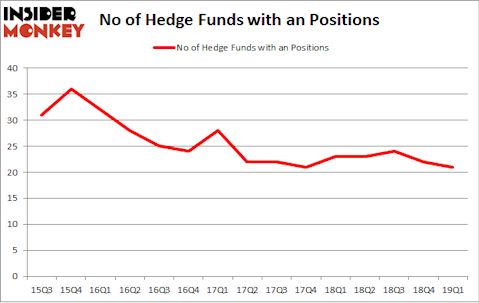

AutoNation, Inc. (NYSE:AN) has experienced a decrease in support from the world’s most elite money managers in recent months. AN was in 21 hedge funds’ portfolios at the end of the first quarter of 2019. There were 22 hedge funds in our database with AN positions at the end of the previous quarter. Our calculations also showed that an isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are many tools stock traders employ to appraise stocks. A pair of the most useful tools are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the elite money managers can trounce the broader indices by a solid margin (see the details here).

Let’s go over the new hedge fund action encompassing AutoNation, Inc. (NYSE:AN).

What does the smart money think about AutoNation, Inc. (NYSE:AN)?

At the end of the first quarter, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of -5% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in AN over the last 15 quarters. With the smart money’s capital changing hands, there exists a few key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

The largest stake in AutoNation, Inc. (NYSE:AN) was held by ESL Investments, which reported holding $129.1 million worth of stock at the end of March. It was followed by Arlington Value Capital with a $122.6 million position. Other investors bullish on the company included Bill & Melinda Gates Foundation Trust, Magnolia Capital Fund, and GAMCO Investors.

Judging by the fact that AutoNation, Inc. (NYSE:AN) has experienced a decline in interest from the smart money, we can see that there is a sect of funds that elected to cut their positions entirely heading into Q3. Interestingly, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital dumped the biggest stake of the “upper crust” of funds watched by Insider Monkey, worth an estimated $6 million in stock, and John Overdeck and David Siegel’s Two Sigma Advisors was right behind this move, as the fund said goodbye to about $3.3 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 1 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to AutoNation, Inc. (NYSE:AN). We will take a look at Wolverine World Wide, Inc. (NYSE:WWW), Green Dot Corporation (NYSE:GDOT), Axon Enterprise, Inc. (NASDAQ:AAXN), and Navistar International Corp (NYSE:NAV). This group of stocks’ market values are similar to AN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WWW | 19 | 124564 | 7 |

| GDOT | 27 | 233849 | 8 |

| AAXN | 19 | 247525 | 3 |

| NAV | 23 | 1335795 | 3 |

| Average | 22 | 485433 | 5.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22 hedge funds with bullish positions and the average amount invested in these stocks was $485 million. That figure was $459 million in AN’s case. Green Dot Corporation (NYSE:GDOT) is the most popular stock in this table. On the other hand Wolverine World Wide, Inc. (NYSE:WWW) is the least popular one with only 19 bullish hedge fund positions. AutoNation, Inc. (NYSE:AN) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on AN as the stock returned 12% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.