The financial regulations require hedge funds and wealthy investors that crossed the $100 million equity holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on June 28th. We at Insider Monkey have made an extensive database of nearly 750 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Assurant, Inc. (NYSE:AIZ) based on those filings.

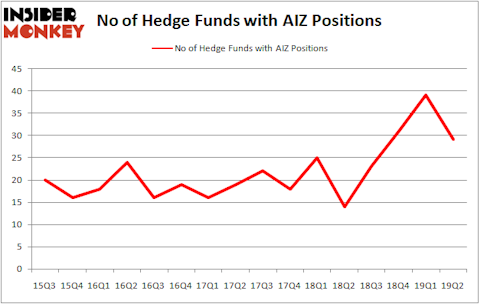

Is Assurant, Inc. (NYSE:AIZ) a buy, sell, or hold? The smart money is in a pessimistic mood. The number of bullish hedge fund bets were trimmed by 10 lately. Our calculations also showed that AIZ isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are several methods investors have at their disposal to grade publicly traded companies. A duo of the best methods are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the best hedge fund managers can trounce their index-focused peers by a significant margin (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s go over the key hedge fund action encompassing Assurant, Inc. (NYSE:AIZ).

How have hedgies been trading Assurant, Inc. (NYSE:AIZ)?

At the end of the second quarter, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of -26% from the first quarter of 2019. On the other hand, there were a total of 14 hedge funds with a bullish position in AIZ a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Assurant, Inc. (NYSE:AIZ) was held by Renaissance Technologies, which reported holding $111.7 million worth of stock at the end of March. It was followed by Samlyn Capital with a $105.1 million position. Other investors bullish on the company included AQR Capital Management, Adage Capital Management, and Viking Global.

Due to the fact that Assurant, Inc. (NYSE:AIZ) has experienced bearish sentiment from the smart money, logic holds that there exists a select few funds that decided to sell off their positions entirely in the second quarter. Interestingly, Israel Englander’s Millennium Management dumped the biggest stake of the “upper crust” of funds followed by Insider Monkey, worth an estimated $11.6 million in stock, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital was right behind this move, as the fund said goodbye to about $9.7 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 10 funds in the second quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Assurant, Inc. (NYSE:AIZ). We will take a look at Dunkin Brands Group Inc (NASDAQ:DNKN), The Madison Square Garden Company (NYSE:MSG), The Gap Inc. (NYSE:GPS), and Pilgrim’s Pride Corporation (NASDAQ:PPC). This group of stocks’ market valuations are similar to AIZ’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DNKN | 23 | 335111 | 1 |

| MSG | 50 | 1807738 | -2 |

| GPS | 21 | 81739 | -6 |

| PPC | 19 | 248654 | 5 |

| Average | 28.25 | 618311 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.25 hedge funds with bullish positions and the average amount invested in these stocks was $618 million. That figure was $516 million in AIZ’s case. The Madison Square Garden Company (NYSE:MSG) is the most popular stock in this table. On the other hand Pilgrim’s Pride Corporation (NASDAQ:PPC) is the least popular one with only 19 bullish hedge fund positions. Assurant, Inc. (NYSE:AIZ) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on AIZ as the stock returned 18.9% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.