It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. This was the case with hedge funds, who we heard were pulling money from the market amid the volatility, which included money from small-cap stocks, which they invest in at a higher rate than other investors. This action contributed to the greater decline in these stocks during the tumultuous period. We will study how this market volatility affected their sentiment towards Assurant, Inc. (NYSE:AIZ) during the quarter below.

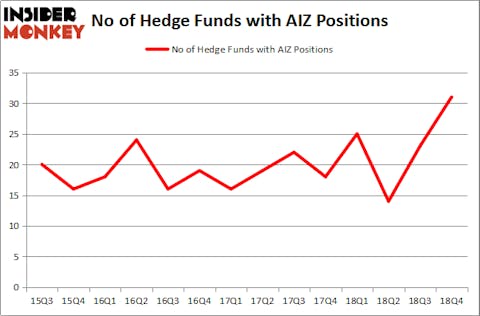

Is Assurant, Inc. (NYSE:AIZ) a buy, sell, or hold? The best stock pickers are becoming more confident. The number of long hedge fund positions rose by 8 in recent months. Our calculations also showed that AIZ isn’t among the 30 most popular stocks among hedge funds. AIZ was in 31 hedge funds’ portfolios at the end of December. There were 23 hedge funds in our database with AIZ positions at the end of the previous quarter.

To most investors, hedge funds are assumed to be unimportant, outdated investment vehicles of the past. While there are over 8000 funds trading at present, Our experts look at the leaders of this group, approximately 750 funds. These investment experts watch over the majority of the hedge fund industry’s total asset base, and by tracking their top investments, Insider Monkey has brought to light several investment strategies that have historically outstripped Mr. Market. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s review the new hedge fund action encompassing Assurant, Inc. (NYSE:AIZ).

Hedge fund activity in Assurant, Inc. (NYSE:AIZ)

At the end of the fourth quarter, a total of 31 of the hedge funds tracked by Insider Monkey were long this stock, a change of 35% from one quarter earlier. On the other hand, there were a total of 25 hedge funds with a bullish position in AIZ a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Assurant, Inc. (NYSE:AIZ) was held by Citadel Investment Group, which reported holding $99.4 million worth of stock at the end of September. It was followed by Samlyn Capital with a $56.6 million position. Other investors bullish on the company included AQR Capital Management, Adage Capital Management, and Strycker View Capital.

Consequently, key hedge funds have been driving this bullishness. Citadel Investment Group, managed by Ken Griffin, established the largest position in Assurant, Inc. (NYSE:AIZ). Citadel Investment Group had $99.4 million invested in the company at the end of the quarter. Daniel Johnson’s Gillson Capital also made a $11.6 million investment in the stock during the quarter. The other funds with new positions in the stock are David MacKnight’s One Fin Capital Management, Joseph Samuels’s Islet Management, and Gregg Moskowitz’s Interval Partners.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Assurant, Inc. (NYSE:AIZ) but similarly valued. These stocks are Donaldson Company, Inc. (NYSE:DCI), Companhia Brasileira de Distrib. (NYSE:CBD), EnCana Corporation (NYSE:ECA), and Signature Bank (NASDAQ:SBNY). This group of stocks’ market values are similar to AIZ’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DCI | 19 | 124101 | 2 |

| CBD | 13 | 79198 | 3 |

| ECA | 40 | 851295 | 8 |

| SBNY | 36 | 597426 | 11 |

| Average | 27 | 413005 | 6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 27 hedge funds with bullish positions and the average amount invested in these stocks was $413 million. That figure was $361 million in AIZ’s case. EnCana Corporation (NYSE:ECA) is the most popular stock in this table. On the other hand Companhia Brasileira de Distrib. (NYSE:CBD) is the least popular one with only 13 bullish hedge fund positions. Assurant, Inc. (NYSE:AIZ) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately AIZ wasn’t in this group. Hedge funds that bet on AIZ were disappointed as the stock returned 7.4% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.