At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

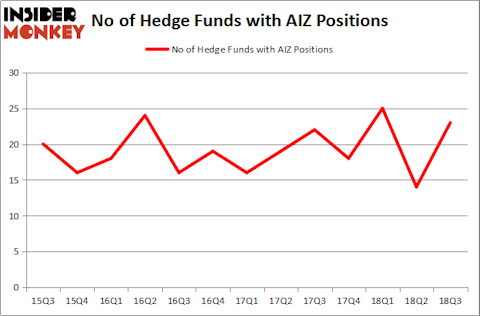

Assurant, Inc. (NYSE:AIZ) has seen an increase in hedge fund interest of late. AIZ was in 23 hedge funds’ portfolios at the end of September. There were 14 hedge funds in our database with AIZ positions at the end of the previous quarter. Our calculations also showed that AIZ isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a gander at the latest hedge fund action encompassing Assurant, Inc. (NYSE:AIZ).

What have hedge funds been doing with Assurant, Inc. (NYSE:AIZ)?

At Q3’s end, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 64% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards AIZ over the last 13 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

The largest stake in Assurant, Inc. (NYSE:AIZ) was held by AQR Capital Management, which reported holding $145.1 million worth of stock at the end of September. It was followed by Samlyn Capital with a $40.1 million position. Other investors bullish on the company included Balyasny Asset Management, Adage Capital Management, and Renaissance Technologies.

As industrywide interest jumped, key money managers have jumped into Assurant, Inc. (NYSE:AIZ) headfirst. Renaissance Technologies, managed by Jim Simons, established the most outsized position in Assurant, Inc. (NYSE:AIZ). Renaissance Technologies had $19.9 million invested in the company at the end of the quarter. Ron Bobman’s Capital Returns Management also initiated a $10.8 million position during the quarter. The following funds were also among the new AIZ investors: Usman Waheed’s Strycker View Capital, Daniel Lascano’s Lomas Capital Management, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Assurant, Inc. (NYSE:AIZ) but similarly valued. We will take a look at James Hardie Industries plc (NYSE:JHX), Pool Corporation (NASDAQ:POOL), Texas Pacific Land Trust (NYSE:TPL), and MarketAxess Holdings Inc. (NASDAQ:MKTX). This group of stocks’ market values resemble AIZ’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JHX | 2 | 4763 | 1 |

| POOL | 17 | 263814 | -2 |

| TPL | 11 | 1652556 | 1 |

| MKTX | 13 | 149475 | 2 |

| Average | 10.75 | 517652 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $518 million. That figure was $328 million in AIZ’s case. Pool Corporation (NASDAQ:POOL) is the most popular stock in this table. On the other hand James Hardie Industries plc (NYSE:JHX) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Assurant, Inc. (NYSE:AIZ) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.