Billionaire Jorge Paulo Lemann‘s 3G Capital is one of the most followed hedge funds in the world. It reported an equity portfolio worth $1.27 billion, as of the end of June, with 42% invested in energy stocks. Consumer discretionary, materials, and technology stocks also amassed substantial shares. Among 3G Capital’s top picks were Charter Communications, Inc. (NASDAQ:CHTR), Pioneer Natural Resources (NYSE:PXD), Steel Dynamics, Inc. (NASDAQ:STLD), and Microsoft Corporation (NASDAQ:MSFT). In this article, we’ll take a closer look at 3G Capital’s positions in these companies, see how they performed in the third quarter and assess the general hedge fund sentiment towards them.

Before, we get to that, let’s take a closer look at 3G Capital. At Insider Monkey, we assess a fund’s performance, by calculating the weighted average return of its long positions in companies valued at over $1.0 billion. Out of 3G Capital’s 36 long positions at the end of June, 34 holdings were included in our calculations and showed a return of 10.77% in the third quarter.

Having said that, let’s take a look at 3G Capital’s investments in the aforementioned stocks.

Charter Communications, Inc. (NASDAQ:CHTR) represented a new position in 3G Capital’s equity portfolio at the end of June, as the fund amassed 563,266 shares worth $128.79 million. The investment paid off pretty well in the following three months, as Charter’s stock advanced by 18.1%. Overall, there were 134 funds from our database long Charter Communications, up by 37% over the quarter. Warren Buffett’s Berkshire Hathaway was the top shareholder of the company with a $2.13 billion stake. On the second spot was Lone Pine Capital which amassed $1.10 billion worth of shares. Moreover, Tiger Global Management LLC, Soroban Capital Partners, and Egerton Capital Limited were also bullish on Charter Communications, Inc. (NASDAQ:CHTR).

Follow Charter Communications Inc (NASDAQ:CHTR)

Follow Charter Communications Inc (NASDAQ:CHTR)

Receive real-time insider trading and news alerts

Pioneer Natural Resources (NYSE:PXD) was another profitable bet of 3G Capital, with the stock appreciating by 22.8% between July and September. At the end of June, the fund held 600,000 shares worth $90.73 million, being one of 74 funds tracked by us long the stock (up by 21% on the quarter). SPO Advisory Corp, managed by John H. Scully, held the number one position in Pioneer Natural Resources (NYSE:PXD), which was worth $919.2 million at the end of the second quarter. On SPO Advisory Corp’s heels was Citadel Investment Group, managed by Ken Griffin, with a $263.9 million position. Some other professional money managers that hold long positions include Israel Englander’s Millennium Management, Andreas Halvorsen’s Viking Global and Stephen Mandel’s Lone Pine Capital.

Follow Pioneer Natural Resources Co (NYSE:PXD)

Follow Pioneer Natural Resources Co (NYSE:PXD)

Receive real-time insider trading and news alerts

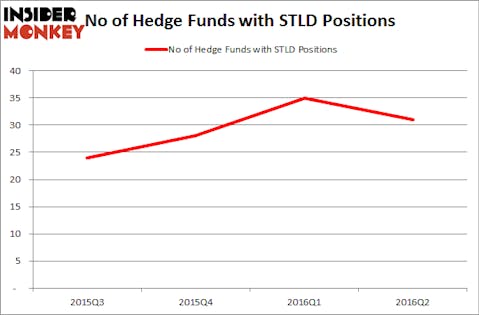

In Steel Dynamics, Inc. (NASDAQ:STLD), 3G Capital amassed 2.50 million shares worth $61.25 million heading into the third quarter, during which the stock inched up by 2.6%. During the second quarter, the number of funds from our database long the company declined by 11% to 31. More specifically, AQR Capital Management was the largest shareholder of Steel Dynamics, Inc. (NASDAQ:STLD), with a stake worth $75.6 millions reported as of the end of June. Trailing AQR Capital Management was 3G Capital. Renaissance Technologies, Anchor Bolt Capital, and Citadel Investment Group also held valuable positions in the company.

Follow Steel Dynamics Inc (NASDAQ:STLD)

Follow Steel Dynamics Inc (NASDAQ:STLD)

Receive real-time insider trading and news alerts

Finally, Microsoft Corporation (NASDAQ:MSFT) was represented in 3G Capital’s equity portfolio by a $51.29 million position containing 1.0 million shares at the end of June. During the following three months, shares of the tech giant gained 13.3%, lifting the returns of 131 funds tracked by us that were long the stock heading into the third quarter. Among these funds, Jeffrey Ubben’s ValueAct Capital had the number one position in Microsoft Corporation (NASDAQ:MSFT), worth close to $2.90 billion. The second most bullish fund manager was Boykin Curry of Eagle Capital Management, with a $1.56 billion position. Remaining peers that held long positions included First Eagle Investment Management, Fisher Asset Management, and Lone Pine Capital.

Follow Microsoft Corp (NASDAQ:MSFT)

Follow Microsoft Corp (NASDAQ:MSFT)

Receive real-time insider trading and news alerts

Disclosure: none