It’s no secret that hedge funds have been underperforming the market for years in aggregate, as many in the media are only all too happy to pound home. That could lead the average reader to think that hedge funds are bad stock pickers, which is not actually the case. When we look at the third-quarter returns of the hedge funds in our database which had at least 5 long positions in companies valued at $1 billion or more, we see their long picks returned 8.3% on average, a full 5.0 percentage points clear of S&P 500 ETFs. However, that long stock-picking prowess is often overshadowed by the hedged portion of their portfolios, in options, bonds, and short positions. We believe that investors should pay attention to hedge funds’ top picks for a chance to beat the market, and will share four such picks today, courtesy of the 13F portfolio of John Scully‘s SPO Advisory Corp.

Out of 16 positions held by SPO in companies valued at $1 billion or more on June 30, the fund’s holdings delivered weighted average returns of 16.7% during the third-quarter, ranking it just outside the top-50 best performing funds in our system during that time. It should be noted that our calculations may be different from the fund’s actual returns, as they do not factor in changes made to positions during the quarter, or positions that don’t get reported on Form 13Fs, like short positions.

In this article, we’ll take a look at four of the favorite stock picks of SPO and see how they performed during the third quarter.

We’ll kick off the stock discussion with Pioneer Natural Resources (NYSE:PXD), which returned 22.8% during the third-quarter. SPO owned 6.08 million shares of the company on June 30, down by 16% over the quarter, though the position still ranked as the fund’s most valuable at the end of June, worth $919 million, accounting for 18.39% of the value of the fund’s $5 billion public equity portfolio. Like many energy stocks, Pioneer has enjoyed a solid rebound in 2016, gaining over 38%.

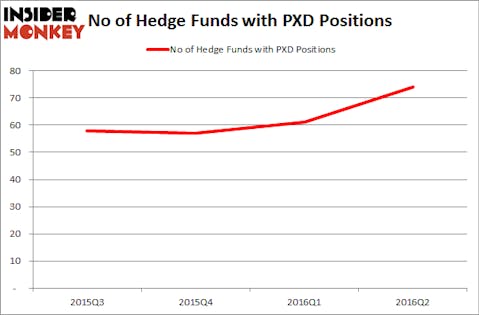

At the end of the second quarter, a total of 74 of the hedge funds tracked by Insider Monkey held long positions in Pioneer, a 21% gain from the previous quarter after remaining relatively flat during the previous two quarters. The largest stake in Pioneer Natural Resources (NYSE:PXD) was held by SPO Advisory Corp. It was followed by Citadel Investment Group with a $263.9 million position. Other investors bullish on the company included Millennium Management, Viking Global, and Lone Pine Capital.

Follow Pioneer Natural Resources Co (NYSE:PXD)

Follow Pioneer Natural Resources Co (NYSE:PXD)

Receive real-time insider trading and news alerts

Let’s move on to LIBERTY GLOBAL PLC (NASDAQ:LBTYK), which posted gains of 15.3% during the third quarter, though shares are still down by 24% this year. SPO is clearly bullish on media companies, as it also owns a large stake in Charter Communications as of June 30. In Liberty Global, the fund owned 27.84 million shares valued at $798 million at the end of June.

SPO was one of 60 hedge funds tracked by Insider Monkey long the stock, unchanged quarter-over-quarter. When looking at the institutional investors followed by Insider Monkey, Eagle Capital Management, managed by Boykin Curry, holds the most valuable position in LIBERTY GLOBAL PLC (NASDAQ:LBTYK). Eagle Capital Management has a $1.02 billion position in the stock, comprising 4.4% of its 13F portfolio. Other professional money managers with similar optimism contain First Eagle Investment Management, Lou Simpson’s SQ Advisors, and John Ku’s Manor Road Capital Partners.

Follow Liberty Global Ltd.

Follow Liberty Global Ltd.

Receive real-time insider trading and news alerts

We’ll check out two more stock picks of SPO Advisory Corp on the next page.