Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Total Return Index ETFs returned 31% through December 23rd. Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 41.1% during the same period. An average long/short hedge fund returned only a fraction of this due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ consensus stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Zoetis Inc (NYSE:ZTS).

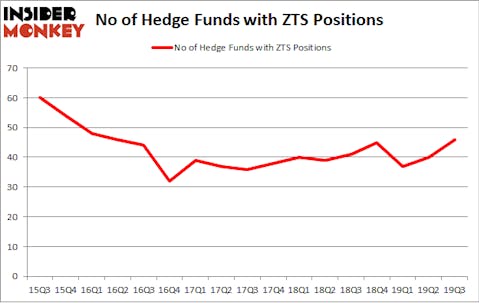

Is Zoetis Inc (NYSE:ZTS) undervalued? Hedge funds are becoming more confident. The number of long hedge fund positions improved by 6 recently. Our calculations also showed that ZTS isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video at the end of this article for Q2 rankings). ZTS was in 46 hedge funds’ portfolios at the end of September. There were 40 hedge funds in our database with ZTS holdings at the end of the previous quarter.

To the average investor there are a lot of signals shareholders put to use to value their holdings. Some of the most under-the-radar signals are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the top investment managers can trounce their index-focused peers by a healthy amount (see the details here).

William Von Mueffling of Cantillon Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Keeping this in mind we’re going to check out the latest hedge fund action regarding Zoetis Inc (NYSE:ZTS).

What does smart money think about Zoetis Inc (NYSE:ZTS)?

At Q3’s end, a total of 46 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15% from the previous quarter. On the other hand, there were a total of 41 hedge funds with a bullish position in ZTS a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Among these funds, Cantillon Capital Management held the most valuable stake in Zoetis Inc (NYSE:ZTS), which was worth $459.3 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $274.2 million worth of shares. Marshall Wace, Millennium Management, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Banbury Partners allocated the biggest weight to Zoetis Inc (NYSE:ZTS), around 8.5% of its 13F portfolio. Harvest Capital Strategies is also relatively very bullish on the stock, setting aside 6.43 percent of its 13F equity portfolio to ZTS.

Consequently, specific money managers were breaking ground themselves. Miura Global Management, managed by Pasco Alfaro / Richard Tumure, established the largest position in Zoetis Inc (NYSE:ZTS). Miura Global Management had $12.5 million invested in the company at the end of the quarter. Vishal Saluja and Pham Quang’s Endurant Capital Management also made a $7.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Perella Weinberg Partners, Jay Genzer’s Thames Capital Management, and Krishen Sud’s Sivik Global Healthcare.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Zoetis Inc (NYSE:ZTS) but similarly valued. We will take a look at Vale SA (NYSE:VALE), The Blackstone Group Inc. (NYSE:BX), Crown Castle International Corp. (REIT) (NYSE:CCI), and CIGNA Corporation (NYSE:CI). This group of stocks’ market valuations are similar to ZTS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VALE | 28 | 1453835 | 7 |

| BX | 41 | 1571733 | 11 |

| CCI | 34 | 1849678 | 1 |

| CI | 62 | 3080624 | 14 |

| Average | 41.25 | 1988968 | 8.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41.25 hedge funds with bullish positions and the average amount invested in these stocks was $1989 million. That figure was $2229 million in ZTS’s case. CIGNA Corporation (NYSE:CI) is the most popular stock in this table. On the other hand Vale SA (NYSE:VALE) is the least popular one with only 28 bullish hedge fund positions. Zoetis Inc (NYSE:ZTS) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.1% in 2019 through December 23rd and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Hedge funds were also right about betting on ZTS as the stock returned 55.7% in 2019 (through December 23rd) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.