Cisco Systems, Inc. (NASDAQ:CSCO) is a giant in the communications technology industry, with a market cap around $90 billion. However, this size has made it tough for the company to navigate the nimble cloud computing and wireless area network sector. The company grew EPS by only 5% annually for the last five years. As well, the company is expected to only see limited improvement over the next five years, with an 8% EPS annual growth rate, so is now a good time to buy Cisco?

Although the company made its largest acquisition in seven years earlier this year, we believe Cisco can make a bigger splash in the cloud computing area. Cisco has been in a heated battle with a number of smaller companies that have been attacking its communications equipment market share, namely in the cloud. We currently see little reason to invest in Cisco, even with a 3.2% dividend yield and a trailing P/E of 12x, given the other higher growth opportunities in the communication and wireless area network optimization space.

These opportunities include Juniper Networks, Inc. (NYSE:JNPR), Riverbed Technology, Inc. (NASDAQ:RVBD), F5 Networks, inc. (NASDAQ:FFIV) and Citrix Systems, Inc. (NASDAQ:CTXS).

Juniper has been reducing staff, as well as lowering 4Q guidance and lowering CapEx plans as a weak demand environment pose risks for the company. One bright spot is that Juniper and Riverbed recently partnered up to deliver better mobile applications in the WAN space. The deal allows Juniper to license Riverbed’s technology for improving network performance for applications across various devices. Cisco trails only Riverbed in WAN market share, after losing significant traction earlier this year. The two are the leaders in WAN, with the other three companies all having less than 10% of the market each.

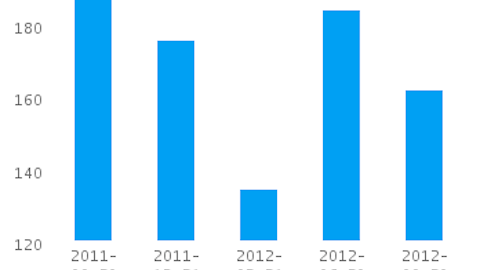

Riverbed has been performing well in the WAN market, having grown sales 31% in 2011, and it’s expected to grow sales 15% in 2012 and 18% in 2013. The WAN market appears to be under-penetrated relative to the return on investment for customers. The company’s stock price tumbled 35% in 2011 on execution issues in the field, but now appears to have remedied these issues.

F5 has felt the decline in IT spending also, and saw a downgrade from Wuderlinch on lower than expected 3Q performance. F5 has strong operations in the enterprise space, but concerns of a weak economy are keeping the shares under pressure. F5 is feeling the slowdown the most in the U.S., where U.S. revenue growth declined 8% for last quarter on a year over year basis. Yet, the company operates in various high growth areas including virtualization, mobile data and application growth and cloud computing adoption. Citrix recently saw its S&P target price lowered to $70, based on declining IT spending. Citrix has been seeing only incremental interest in desktop virtualization, which may signal a peaking of the company’s target segment. Desktop Solutions license growth only came in at 7% year over year for 2Q, well below consensus of 10-11%. License growth, meanwhile, saw a decline of 1% year over year for 3Q.

While most of the appeal for Cisco comes from income-oriented investors, we believe that with the right acquisition, the company could be attractive, specifically as an income with growth capabilities opportunity. Even though we remain cautious on what Cisco can do alone, Ken Fisher has confidence, at least that Cisco can make a key acquisition. Fisher upped his 1Q stake in 2Q by over 30,000% and owns 21 million shares.

Some of the most fund interest for the smaller tech companies during 2Q was in Riverbed and F5 Networks. Riverbed saw AQR Capital, Israel Englander and D.E. Shaw all upping their 1Q stakes by over 500%. F5 networks had Jim Simons and Arrowstreet Capital each upping their 1Q stakes over 1000%.

With almost $50 billion in cash and short term investments, Cisco could easily snatch up any of these tech companies, as all of them trade at market caps less than $12 billion. While some of the stocks, namely Riverbed, might appear to be trading a bit rich, we believe the company still poses significant value. Riverbed and Juniper both trade at the high end of the peer range, at 54x and 47x, respectively.

We believe that Riverbed and F5 have some of the best growth prospects and even without being acquired by Cisco could provide solid returns to investors over the long term. Both of these companies are expected to grow 5-year EPS at 20% annually and both trade at forward P/Es that are very attractive, with Riverbed at 19x and F5 at 14x.