After the market close on Thursday, Janet Yellen cleared away some ambiguity around the low interest rate environment, claiming that most FOMC participants opt for an increase in interest rates by the end of the year. However, potential economic “surprises” may delay that decision, according to the Fed Chair. In the meantime, the U.S. stock markets pulled back for the fifth time in six days since the end of the Fed’s two-day policy meeting this month. At the same time, some tend to think that algorithms and quants spur volatility and stand behind these major swings in equity markets. Unquestionably, the recent stock market mini-crashes have pushed equity valuations into cheap territory, which might have guided some corporate executives to buy their companies’ stock. The Insider Monkey team pinpointed three companies that had an unusual volume of insider buying recently, so we will attempt to assess whether this activity might create some trading opportunities. Fenix Parts Inc. (NASDAQ:FENX), Farmers National Banc Corp (NASDAQ:FMNB), and Lululemon Athletica Inc. (NASDAQ:LULU) are three companies that have received a vote of confidence from their insiders recently.

Most investors can’t outperform the stock market by individually picking stocks because stock returns aren’t evenly distributed. A randomly picked stock has only a 35% to 45% chance (depending on the investment horizon) to outperform the market. There are a few exceptions, one of which is when it comes to purchases made by corporate insiders. Academic research has shown that certain insider purchases historically outperformed the market by an average of seven percentage points per year. This effect is more pronounced in small-cap stocks. Another exception is the small-cap stock picks of hedge funds. Our research has shown that the 15 most popular small-cap stocks among hedge funds outperformed the market by nearly a percentage point per month between 1999 and 2012. We have been forward testing the performance of these stock picks since the end of August 2012 and they have returned more than 118% over the ensuing 36 months, outperforming the S&P 500 Index by nearly 61 percentage points (read the details here). The trick is focusing only on the best small-cap stock picks of funds, not their large-cap stock picks which are extensively covered by analysts and followed by almost everybody.

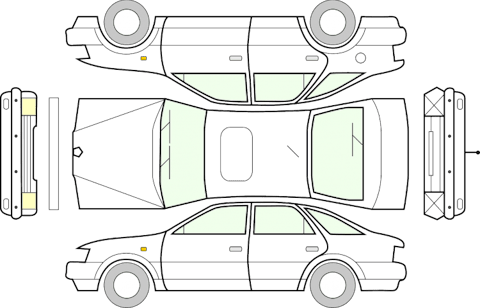

Fenix Parts Inc. (NASDAQ:FENX), a recycler and reseller of auto parts, saw two insiders acquire stock this week. John C. Blaseos, who acts as the Executive Vice President of Supply Chain Management of Fenix Parts, reported acquiring 2,800 shares on Monday and 900 shares on Tuesday at prices in the range of $8.11 and $8.13 per share. After this week’s transactions, the executive currently owns 48,700 shares. Director Michael J. McFall also purchased 6,150 shares earlier this week at $8.15 per unit, boosting his stake to 55,189 shares. The previous week was even busier that the current one in terms of insider activity at Fenix, with five different insiders acquiring stock on Friday alone. Over the past few weeks, the company has been scrutinized for delaying to file its second-quarter Form 10-Q, but recently managed to file it, blaming the complexity and the extensive process required to compile the information. The company’s shares have lost nearly 10% since its IPO on May 19, so insiders might be buying shares on weakness at the moment. Malcolm Fairbairn’s Ascend Capital is one of the hedge funds tracked by Insider Monkey that poured cash and faith in Fenix Parts Inc. (NASDAQ:FENX), owning 1.84 million shares as of June 30.

Follow Fenix Parts Inc. (NASDAQ:FENX)

Follow Fenix Parts Inc. (NASDAQ:FENX)

Receive real-time insider trading and news alerts