Let’s now move on to Farmers National Banc Corp (NASDAQ:FMNB), which operates as a holding company for the Farmers National Bank of Canfield. Director Terry A. Moore reported purchasing 17,500 shares through multiple transactions dated September 22 at prices ranging from $8.26 to $8.50, all of which are owned indirectly through the Virginia Ann Watterson Irr Trust. At the same time, Moore directly owns an additional amount of 15,220 shares, along with 6,700 other shares held indirectly. Similarly, Mark R. Witmer, Senior Executive Vice President and Chief Banking Officer, purchased 16,162 shares last week at prices of $7.86 to $8.18 per share and enlarged his holding to 110,683 shares. The bank’s stock performance has been relatively stable this year, but its shares are still slightly over 1% in the red year-to-date. Earlier this week, the shareholders of Tri-State 1st Banc Inc. (OTC:TSOH) approved the Agreement and Plan of Merger related to Tri-State’s merger with one of Farmers National Banc’s subsidiaries. The following merger is expected to be finalized on October 1, so insiders might see more room for the stock in the upcoming months. Fred Cummings’ Elizabeth Park Capital Management is the top shareholder of Farmers National Banc Corp (NASDAQ:FMNB) within our database, with an ownership of slightly over 542,000 shares.

Follow Farmers National Banc Corp (NASDAQ:FMNB)

Follow Farmers National Banc Corp (NASDAQ:FMNB)

Receive real-time insider trading and news alerts

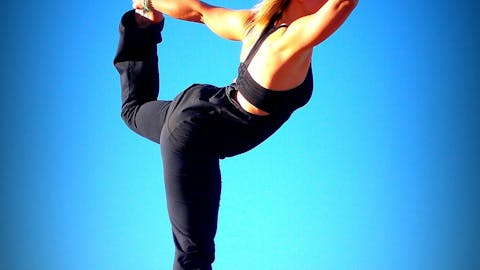

Finally, we will examine the insider buying activity at Lululemon Athletica Inc. (NASDAQ:LULU). Tara Poseley, Chief Product Officer, bought 4,000 shares on Monday for $53.515 each. Following the recent transaction, the CPO currently holds 24,535 shares. The stock of the manufacturer of technical athletic apparel has dropped more than 17% since it released its financial results for the second quarter earlier this month. Just recently, Morgan Stanley upgraded the shares of Lululemon to ‘Overweight’ from ‘Equal Weight’ and updated its price target to $68 from $56 (read more details here). MKM Partners, which recently initiated coverage on the stock, assigned Lululemon Athletica a price target of $69. The hedge funds observed by our team seem to believe in the future prospects of the company, with 35 top money managers invested in the stock at the end of the second quarter, compared to 32 registered in the prior quarter. Ken Griffin’s Citadel Investment Group is one of the most bullish hedge funds on Lululemon Athletica Inc. (NASDAQ:LULU) with 2.03 million shares.

Follow Lululemon Athletica Inc. (NASDAQ:LULU)

Follow Lululemon Athletica Inc. (NASDAQ:LULU)

Receive real-time insider trading and news alerts

Disclosure: None