Hong-Kong based, tech-focused hedge fund Keywise Capital Management recently submitted its 13F for the September quarter with the SEC, revealing a U.S public equity portfolio worth $225.79 million at the end of September. Founded by Fang Zheng, the fund currently manages regulatory assets worth over $1.6 billion and primarily invests in companies based in the Greater China market.

Keywise Capital Management has always run a concentrated U.S equity portfolio, however, its last two 13F filings suggests that it has been increasing its exposure to the American market. According to the latest filing, Keywise Capital initiated a stake in four stocks and sold out of only one stock during the third quarter, thereby increasing the size of its portfolio to 15 holdings at the end of September from 12 holdings at the end of June. In this article, we’ll take a look at the fund’s top five stock picks at the end of third quarter and will discuss how these stocks have performed of late.

– Related Reading: 11 Surreal Places to Visit in China Before You Die

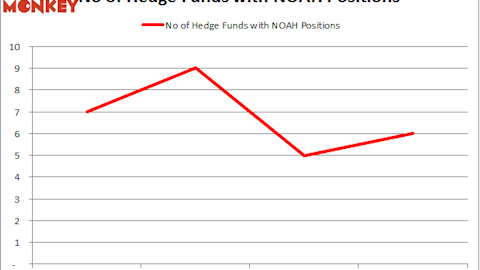

At Insider Monkey, we track around 750 hedge funds and institutional investors. Through extensive backtests, we have determined that imitating some of the stocks that these investors are collectively bullish on can help retail investors generate double digits of alpha per year. The key is to focus on the small-cap picks of these funds, which are usually less followed by the broader market and allow for larger price inefficiencies (see more details about our small-cap strategy).

#5 Alibaba Group Holding Ltd (NYSE:BABA)

– Shares Owned by Keywise Capital Management (as of September 30): 97,720

– Value of the Holding (as of September 30): $10.34 Million

Keywise Capital Management initiated a stake in Alibaba Group Holding Ltd (NYSE:BABA) during the first quarter, when the stock was trading under $80. During the third quarter, amid an over 30% rise in the stock, the fund booked some profit by reducing its stake in the company by 46%. Considering that the stock has fallen considerably in the current quarter, especially after the election results, it seems the fund made a wise decision by reducing its holding. Though Alibaba Group Holding Ltd (NYSE:BABA) reported stellar numbers for its fiscal year 2017 second quarter earlier this month, investors are concerned that with Donald Trump at the helm, there is a possibility of tariffs being imposed on Chinese imports to the U.S, which would affect Alibaba’s business. Most analysts who track the stock are also not bullish on it in the short-term, citing the possibility of further devaluation of the Yuan and the ongoing SEC investigation against the company on charges of accounting fraud.

Follow Alibaba Group Holding Limited (NYSE:BABA)

Follow Alibaba Group Holding Limited (NYSE:BABA)

Receive real-time insider trading and news alerts

#4 TAL Education Group (ADR) (NYSE:XRS)

– Shares Owned by Keywise Capital Management (as of September 30): 149,800

– Value of the Holding (as of September 30): $10.61 Million

TAL Education Group (ADR) (NYSE:XRS) was a new entrant in Keywise Capital Management’s equity portfolio during the third quarter. The company is engaged in the business of providing after-school tutoring programs for primary and secondary school students in China. TAL Education Group (ADR) (NYSE:XRS)’s stock has witnessed a massive rally this year and even after correcting by more than 12% since the election results were announced, is still up by 51.75% for 2016. For its most recent quarter, the company reported EPS of $0.70 on revenue of $271.12 million, beating analysts estimates by a hearty $0.17 and $20.6 million, respectively. Following the double beat, analysts at Credit Suisse Group AG upgraded the stock to ‘Outperform’ from ‘Neutral’ on October 28.

Follow Tal Education Group (NYSE:TAL)

Follow Tal Education Group (NYSE:TAL)

Receive real-time insider trading and news alerts

We’ll check out Keywise’s three favorite U.S-traded stocks on the next page.