After a lengthy stretch of outperformance, small-cap stocks suffered from July 2015 through June 2016, as heightened global economic fears led investors to flee to the safe havens of large-cap stocks and other instruments. Those stocks outperformed small-caps by about 10 percentage points during that time, with small-cap healthcare stocks being particularly hard hit. However, the tide has since turned in a big way, as evidenced by small-caps toppling their large-cap peers by 5 percentage points in the third quarter, and by another 5 percentage points in the first seven weeks of the fourth quarter. In this article, we’ll analyze how this shift affected hedge funds’ Q3 trading of Exelon Corporation (NYSE:EXC) and see how the stock is affected by the recent hedge fund activity.

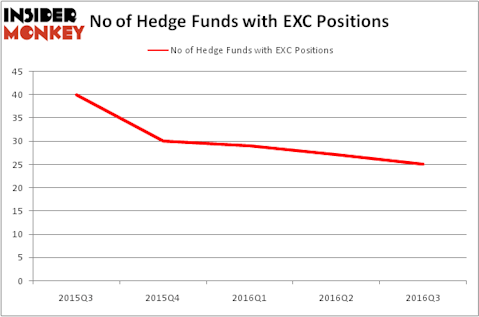

Is Exelon Corporation (NYSE:EXC) a bargain? Hedge funds are getting less optimistic. The number of bullish hedge fund bets shrunk by 2 recently. EXC was in 25 hedge funds’ portfolios at the end of the third quarter of 2016. There were 27 hedge funds in our database with EXC holdings at the end of the previous quarter. At the end of this article we will also compare EXC to other stocks including Praxair, Inc. (NYSE:PX), Barclays PLC (ADR) (NYSE:BCS), and TransCanada Corporation (USA) (NYSE:TRP) to get a better sense of its popularity.

Follow Exelon Corp (NASDAQ:EXC)

Follow Exelon Corp (NASDAQ:EXC)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

Keeping this in mind, we’re going to review the recent action encompassing Exelon Corporation (NYSE:EXC).

Hedge fund activity in Exelon Corporation (NYSE:EXC)

Heading into the fourth quarter of 2016, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a decrease of 7% from the previous quarter. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the most valuable position in Exelon Corporation (NYSE:EXC), worth close to $212.8 million, accounting for 0.7% of its total 13F portfolio. On Arrowstreet Capital’s heels is Cliff Asness of AQR Capital Management, with a $180.3 million position; 0.3% of its 13F portfolio is allocated to the stock. Other professional money managers with similar optimism contain Israel Englander’s Millennium Management, D. E. Shaw’s D E Shaw and Joe Huber’s Huber Capital Management.