Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Liberty Broadband Corp (NASDAQ:LBRDK)? The smart money sentiment can provide an answer to this question.

During the third quarter, the number of bullish hedge fund bets inched down by one, but the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as FMC Corp (NYSE:FMC), Liberty Broadband Corp (NASDAQ:LBRDA), and Spirit Realty Capital Inc (NYSE:SRC) to gather more data points.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Shutter_M/Shutterstock.com

With all of this in mind, let’s take a peek at the recent action regarding Liberty Broadband Corp (NASDAQ:LBRDK).

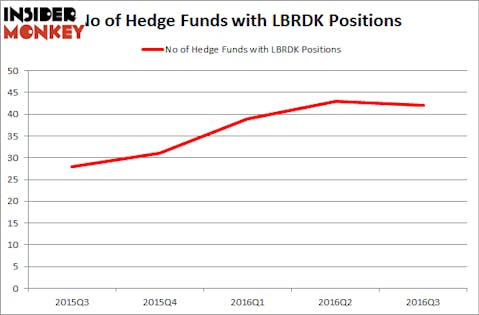

How have hedgies been trading Liberty Broadband Corp (NASDAQ:LBRDK)?

Among the funds in the Insider Monkey database, 42 funds were bullish on Liberty Broadband Corp (NASDAQ:LBRDK) at the end of September, down by 2% from the end of the second quarter of 2016. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, George Soros’ Soros Fund Management holds the biggest position in Liberty Broadband Corp (NASDAQ:LBRDK). Soros Fund Management has a $636.1 million position in the stock, comprising 15.9% of its 13F portfolio. The second most bullish fund manager is Soroban Capital Partners, led by Eric W. Mandelblatt, holding a $635.6 million position; the fund has 3.9% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions contain Philippe Laffont’s Coatue Management, Barry Rosenstein’s JANA Partners, and Wallace Weitz’s Wallace R. Weitz & Co..

Because Liberty Broadband Corp (NASDAQ:LBRDK) has witnessed a decline in interest from hedge fund managers, it’s easy to see that there lies a certain “tier” of money managers that slashed their positions entirely by the end of the third quarter. At the top of the heap, Michael Thompson’s BHR Capital dumped the biggest investment of the 700 funds followed by Insider Monkey, worth about $6 million in stock. Morris Mark’s fund, Mark Asset Management, also dropped its stock, about $4 million worth.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Liberty Broadband Corp (NASDAQ:LBRDK) but similarly valued. We will take a look at FMC Corp (NYSE:FMC), Liberty Broadband Corp (NASDAQ:LBRDA), Spirit Realty Capital Inc (NYSE:SRC), and Companhia de Saneamento Basico (ADR) (NYSE:SBS). All of these stocks’ market caps match LBRDK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FMC | 28 | 1015438 | -9 |

| LBRDA | 27 | 399996 | 1 |

| SRC | 17 | 340235 | -3 |

| SBS | 16 | 206265 | 0 |

As you can see these stocks had an average of 22 hedge funds holding long positions and the average amount invested in these stocks was $490 million. That figure was $3.75 billion in LBRDK’s case. FMC Corp (NYSE:FMC) is the most popular stock in this table, while Companhia de Saneamento Basico (ADR) (NYSE:SBS) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks, Liberty Broadband Corp (NASDAQ:LBRDK) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.