In this article we will check out the progression of hedge fund sentiment towards National Instruments Corporation (NASDAQ:NATI) and determine whether it is a good investment right now. We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also employ numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

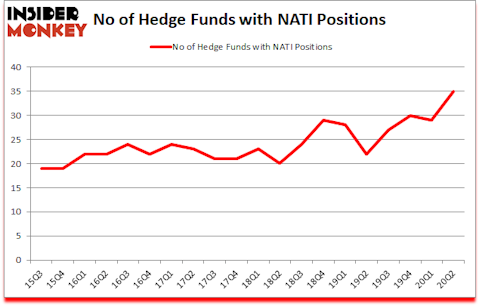

National Instruments Corporation (NASDAQ:NATI) was in 35 hedge funds’ portfolios at the end of June. The all time high for this statistics is 30. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. NATI has experienced an increase in enthusiasm from smart money recently. There were 29 hedge funds in our database with NATI holdings at the end of March. Our calculations also showed that NATI isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are plenty of indicators investors can use to evaluate stocks. A duo of the most under-the-radar indicators are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the elite hedge fund managers can beat their index-focused peers by a significant margin (see the details here).

Chuck Royce of Royce & Associates

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Last week, most investors overlooked a major development because of the presidential elections: Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 best high dividend stocks to buy to identify high dividend stocks with upside potential in this low interest rate environment. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Now let’s take a gander at the new hedge fund action encompassing National Instruments Corporation (NASDAQ:NATI).

What have hedge funds been doing with National Instruments Corporation (NASDAQ:NATI)?

At the end of June, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of 21% from the previous quarter. On the other hand, there were a total of 22 hedge funds with a bullish position in NATI a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the largest position in National Instruments Corporation (NASDAQ:NATI). Royce & Associates has a $60.9 million position in the stock, comprising 0.7% of its 13F portfolio. On Royce & Associates’s heels is Paul Marshall and Ian Wace of Marshall Wace LLP, with a $33.3 million position; 0.2% of its 13F portfolio is allocated to the company. Other members of the smart money that are bullish comprise D. E. Shaw’s D E Shaw, Brian Bares’s Bares Capital Management and Thyra Zerhusen’s Fairpointe Capital. In terms of the portfolio weights assigned to each position Jade Capital Advisors allocated the biggest weight to National Instruments Corporation (NASDAQ:NATI), around 5.27% of its 13F portfolio. Southport Management is also relatively very bullish on the stock, designating 4.34 percent of its 13F equity portfolio to NATI.

As industrywide interest jumped, key money managers have jumped into National Instruments Corporation (NASDAQ:NATI) headfirst. Fairpointe Capital, managed by Thyra Zerhusen, created the largest position in National Instruments Corporation (NASDAQ:NATI). Fairpointe Capital had $18.9 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $6.5 million investment in the stock during the quarter. The following funds were also among the new NATI investors: Michael Gelband’s ExodusPoint Capital, Donald Sussman’s Paloma Partners, and Mika Toikka’s AlphaCrest Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as National Instruments Corporation (NASDAQ:NATI) but similarly valued. These stocks are CDK Global Inc (NASDAQ:CDK), Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC), Lincoln Electric Holdings, Inc. (NASDAQ:LECO), Euronet Worldwide, Inc. (NASDAQ:EEFT), Mirati Therapeutics, Inc. (NASDAQ:MRTX), Old Republic International Corporation (NYSE:ORI), and Dada Nexus Limited (NASDAQ:DADA). All of these stocks’ market caps are closest to NATI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CDK | 32 | 323704 | 8 |

| TKC | 5 | 48945 | 2 |

| LECO | 22 | 204039 | 3 |

| EEFT | 37 | 311496 | 7 |

| MRTX | 36 | 1586629 | 3 |

| ORI | 26 | 232497 | -1 |

| DADA | 17 | 64230 | 17 |

| Average | 25 | 395934 | 5.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $396 million. That figure was $259 million in NATI’s case. Euronet Worldwide, Inc. (NASDAQ:EEFT) is the most popular stock in this table. On the other hand Turkcell Iletisim Hizmetleri A.S. (NYSE:TKC) is the least popular one with only 5 bullish hedge fund positions. National Instruments Corporation (NASDAQ:NATI) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for NATI is 86.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and beat the market again by 20.1 percentage points. Unfortunately NATI wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on NATI were disappointed as the stock returned -18.6% since the end of June (through 10/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow National Instruments Corp (NASDAQ:NATI)

Follow National Instruments Corp (NASDAQ:NATI)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.