We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards National Instruments Corporation (NASDAQ:NATI).

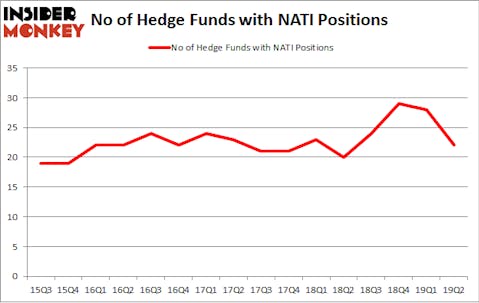

National Instruments Corporation (NASDAQ:NATI) investors should pay attention to a decrease in hedge fund sentiment lately. Our calculations also showed that NATI isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are tons of tools shareholders have at their disposal to grade stocks. A pair of the less utilized tools are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the best hedge fund managers can beat their index-focused peers by a significant margin (see the details here).

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the recent hedge fund action surrounding National Instruments Corporation (NASDAQ:NATI).

How are hedge funds trading National Instruments Corporation (NASDAQ:NATI)?

At the end of the second quarter, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -21% from the previous quarter. On the other hand, there were a total of 20 hedge funds with a bullish position in NATI a year ago. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

The largest stake in National Instruments Corporation (NASDAQ:NATI) was held by Bares Capital Management, which reported holding $171.3 million worth of stock at the end of March. It was followed by Royce & Associates with a $73 million position. Other investors bullish on the company included Arrowstreet Capital, Praesidium Investment Management Company, and Millennium Management.

Judging by the fact that National Instruments Corporation (NASDAQ:NATI) has experienced falling interest from the aggregate hedge fund industry, it’s easy to see that there exists a select few fund managers that decided to sell off their entire stakes by the end of the second quarter. Interestingly, John Orrico’s Water Island Capital dumped the biggest investment of the “upper crust” of funds watched by Insider Monkey, totaling about $25.4 million in stock. Andrew Feldstein and Stephen Siderow’s fund, Blue Mountain Capital, also cut its stock, about $8.2 million worth. These transactions are interesting, as total hedge fund interest fell by 6 funds by the end of the second quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as National Instruments Corporation (NASDAQ:NATI) but similarly valued. These stocks are The New York Times Company (NYSE:NYT), Harley-Davidson, Inc. (NYSE:HOG), Healthcare Trust Of America Inc (NYSE:HTA), and The Howard Hughes Corporation (NYSE:HHC). This group of stocks’ market valuations are closest to NATI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NYT | 41 | 1278691 | 9 |

| HOG | 14 | 49999 | -2 |

| HTA | 13 | 405532 | -6 |

| HHC | 26 | 551404 | 4 |

| Average | 23.5 | 571407 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $571 million. That figure was $487 million in NATI’s case. The New York Times Company (NYSE:NYT) is the most popular stock in this table. On the other hand Healthcare Trust Of America Inc (NYSE:HTA) is the least popular one with only 13 bullish hedge fund positions. National Instruments Corporation (NASDAQ:NATI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately NATI wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); NATI investors were disappointed as the stock returned 0.6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks (see the video below) among hedge funds as many of these stocks already outperformed the market so far in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.