Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and a 20% drop in stock prices. Things completely reversed in 2019 and stock indices hit record highs. Recent hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards HP Inc. (NYSE:HPQ) to find out whether it was one of their high conviction long-term ideas.

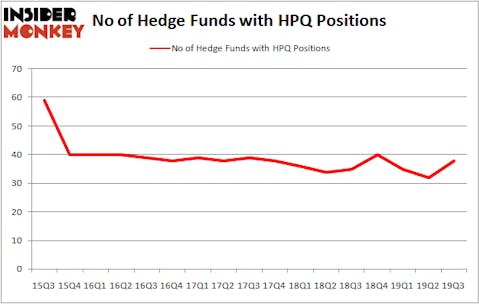

HP Inc. (NYSE:HPQ) was in 38 hedge funds’ portfolios at the end of the third quarter of 2019. HPQ shareholders have witnessed an increase in support from the world’s most elite money managers lately. There were 32 hedge funds in our database with HPQ holdings at the end of the previous quarter. Our calculations also showed that HPQ isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are dozens of gauges stock market investors employ to analyze stocks. A pair of the most innovative gauges are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the top picks of the elite investment managers can trounce the market by a healthy amount (see the details here).

Carl Icahn of Icahn Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to review the fresh hedge fund action encompassing HP Inc. (NYSE:HPQ).

How have hedgies been trading HP Inc. (NYSE:HPQ)?

At the end of the third quarter, a total of 38 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 19% from one quarter earlier. On the other hand, there were a total of 35 hedge funds with a bullish position in HPQ a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

The largest stake in HP Inc. (NYSE:HPQ) was held by Icahn Capital, which reported holding $1190.1 million worth of stock at the end of September. It was followed by AQR Capital Management with a $347.5 million position. Other investors bullish on the company included D E Shaw, Citadel Investment Group, and Two Sigma Advisors. In terms of the portfolio weights assigned to each position Icahn Capital allocated the biggest weight to HP Inc. (NYSE:HPQ), around 4.63% of its portfolio. Sensato Capital Management is also relatively very bullish on the stock, earmarking 1.85 percent of its 13F equity portfolio to HPQ.

As aggregate interest increased, key hedge funds have jumped into HP Inc. (NYSE:HPQ) headfirst. Icahn Capital, managed by Carl Icahn, established the most outsized position in HP Inc. (NYSE:HPQ). Icahn Capital had $1.1901 billion invested in the company at the end of the quarter. Renaissance Technologies also initiated a $25.3 million position during the quarter. The following funds were also among the new HPQ investors: Paul Marshall and Ian Wace’s Marshall Wace, Paul Tudor Jones’s Tudor Investment Corp, and Brandon Haley’s Holocene Advisors.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as HP Inc. (NYSE:HPQ) but similarly valued. We will take a look at PPG Industries, Inc. (NYSE:PPG), Sirius XM Holdings Inc (NASDAQ:SIRI), TransDigm Group Incorporated (NYSE:TDG), and Republic Services, Inc. (NYSE:RSG). This group of stocks’ market caps match HPQ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PPG | 27 | 421872 | 0 |

| SIRI | 33 | 1274312 | 4 |

| TDG | 56 | 5183262 | 8 |

| RSG | 31 | 625488 | 7 |

| Average | 36.75 | 1876234 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.75 hedge funds with bullish positions and the average amount invested in these stocks was $1876 million. That figure was $2031 million in HPQ’s case. TransDigm Group Incorporated (NYSE:TDG) is the most popular stock in this table. On the other hand PPG Industries, Inc. (NYSE:PPG) is the least popular one with only 27 bullish hedge fund positions. HP Inc. (NYSE:HPQ) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on HPQ, though not to the same extent, as the stock returned 6.1% during the first two months of the fourth quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.