At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) at the end of the first quarter and determine whether the smart money was really smart about this stock.

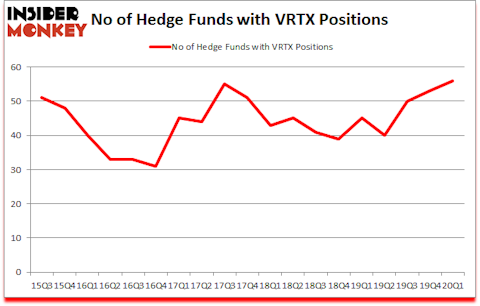

Is Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) the right investment to pursue these days? The best stock pickers were taking an optimistic view. The number of long hedge fund positions went up by 3 recently. Our calculations also showed that VRTX isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). VRTX was in 56 hedge funds’ portfolios at the end of the first quarter of 2020. There were 53 hedge funds in our database with VRTX holdings at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Dmitry Balyasny of Balyasny Asset Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, this trader claims to score lucrative profits by utilizing a “weekend trading strategy”, so we look into his strategy’s picks. Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost gold prices. So, we are checking out this junior gold mining stock. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We recently recommended several stocks partly inspired by legendary Bill Miller’s investor letter. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s take a look at the latest hedge fund action encompassing Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX).

What does smart money think about Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX)?

At Q1’s end, a total of 56 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from the fourth quarter of 2019. Below, you can check out the change in hedge fund sentiment towards VRTX over the last 18 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), with a stake worth $1632.3 million reported as of the end of September. Trailing Renaissance Technologies was Two Sigma Advisors, which amassed a stake valued at $262.2 million. Adage Capital Management, OrbiMed Advisors, and GQG Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Copernicus Capital Management allocated the biggest weight to Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), around 15.1% of its 13F portfolio. Parkman Healthcare Partners is also relatively very bullish on the stock, earmarking 4.72 percent of its 13F equity portfolio to VRTX.

As industrywide interest jumped, key hedge funds have jumped into Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) headfirst. Rhenman & Partners Asset Management, managed by Henrik Rhenman, created the largest position in Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX). Rhenman & Partners Asset Management had $27.4 million invested in the company at the end of the quarter. Ken Heebner’s Capital Growth Management also made a $20.2 million investment in the stock during the quarter. The following funds were also among the new VRTX investors: Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Arsani William’s Logos Capital, and Minhua Zhang’s Weld Capital Management.

Let’s check out hedge fund activity in other stocks similar to Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX). These stocks are Dominion Energy Inc. (NYSE:D), Crown Castle International Corp. (NYSE:CCI), Intuit Inc. (NASDAQ:INTU), and S&P Global Inc. (NYSE:SPGI). All of these stocks’ market caps match VRTX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| D | 34 | 371177 | -3 |

| CCI | 40 | 1640829 | 2 |

| INTU | 54 | 1557455 | 0 |

| SPGI | 73 | 2586131 | -3 |

| Average | 50.25 | 1538898 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 50.25 hedge funds with bullish positions and the average amount invested in these stocks was $1539 million. That figure was $3314 million in VRTX’s case. S&P Global Inc. (NYSE:SPGI) is the most popular stock in this table. On the other hand Dominion Energy Inc. (NYSE:D) is the least popular one with only 34 bullish hedge fund positions. Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th but still beat the market by 15.5 percentage points. Hedge funds were also right about betting on VRTX, though not to the same extent, as the stock returned 22% during the second quarter and outperformed the market as well.

Follow Vertex Pharmaceuticals Inc / Ma (NASDAQ:VRTX)

Follow Vertex Pharmaceuticals Inc / Ma (NASDAQ:VRTX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.