We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the fourth quarter, which unveil their equity positions as of December 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Ventas, Inc. (NYSE:VTR).

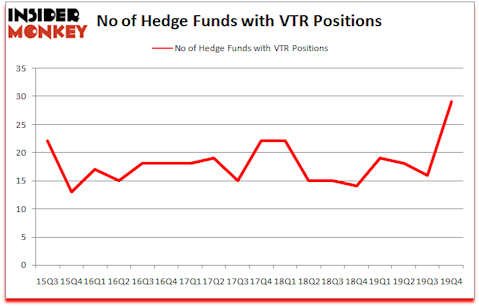

Ventas, Inc. (NYSE:VTR) investors should pay attention to an increase in activity from the world’s largest hedge funds lately. VTR was in 29 hedge funds’ portfolios at the end of December. There were 16 hedge funds in our database with VTR holdings at the end of the previous quarter. Our calculations also showed that VTR isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Dmitry Balyasny of Balyasny Asset Management

We leave no stone unturned when looking for the next great investment idea. For example, COVID-19 pandemic is still the main driver of stock prices. So we are checking out this trader’s corona catalyst trades. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s review the new hedge fund action surrounding Ventas, Inc. (NYSE:VTR).

Hedge fund activity in Ventas, Inc. (NYSE:VTR)

At Q4’s end, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 81% from the third quarter of 2019. The graph below displays the number of hedge funds with bullish position in VTR over the last 18 quarters. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, John Khoury’s Long Pond Capital has the largest position in Ventas, Inc. (NYSE:VTR), worth close to $239.5 million, amounting to 6.1% of its total 13F portfolio. On Long Pond Capital’s heels is Renaissance Technologies, which holds a $214.9 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions consist of Stephen DuBois’s Camber Capital Management, Greg Poole’s Echo Street Capital Management and Phill Gross and Robert Atchinson’s Adage Capital Management. In terms of the portfolio weights assigned to each position Long Pond Capital allocated the biggest weight to Ventas, Inc. (NYSE:VTR), around 6.12% of its 13F portfolio. Hill Winds Capital is also relatively very bullish on the stock, dishing out 4.07 percent of its 13F equity portfolio to VTR.

As one would reasonably expect, specific money managers were leading the bulls’ herd. Long Pond Capital, managed by John Khoury, established the most outsized position in Ventas, Inc. (NYSE:VTR). Long Pond Capital had $239.5 million invested in the company at the end of the quarter. Stephen DuBois’s Camber Capital Management also initiated a $43.3 million position during the quarter. The other funds with brand new VTR positions are Greg Poole’s Echo Street Capital Management, Dmitry Balyasny’s Balyasny Asset Management, and Stuart J. Zimmer’s Zimmer Partners.

Let’s now take a look at hedge fund activity in other stocks similar to Ventas, Inc. (NYSE:VTR). We will take a look at Halliburton Company (NYSE:HAL), Sprint Corporation (NYSE:S), ORIX Corporation (NYSE:IX), and Wipro Limited (NYSE:WIT). All of these stocks’ market caps are similar to VTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HAL | 31 | 1208089 | -4 |

| S | 35 | 778974 | 11 |

| IX | 6 | 8292 | 1 |

| WIT | 12 | 98211 | 0 |

| Average | 21 | 523392 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $523 million. That figure was $656 million in VTR’s case. Sprint Corporation (NYSE:S) is the most popular stock in this table. On the other hand ORIX Corporation (NYSE:IX) is the least popular one with only 6 bullish hedge fund positions. Ventas, Inc. (NYSE:VTR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but beat the market by 12.9 percentage points. Unfortunately VTR wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on VTR were disappointed as the stock returned -46% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.