We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of December. At Insider Monkey, we follow nearly 835 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is The St. Joe Company (NYSE:JOE), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

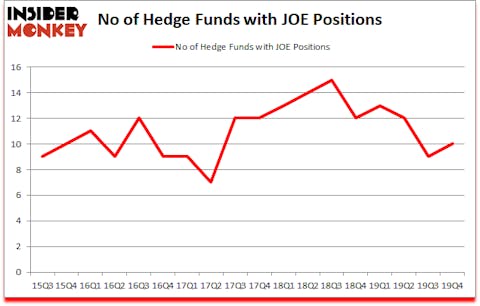

Is The St. Joe Company (NYSE:JOE) a buy here? Hedge funds are buying. The number of long hedge fund bets improved by 1 in recent months. Our calculations also showed that JOE isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

We leave no stone unturned when looking for the next great investment idea. For example, COVID-19 pandemic is still the main driver of stock prices. So we are checking out this trader’s corona catalyst trades. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to take a peek at the key hedge fund action surrounding The St. Joe Company (NYSE:JOE).

What have hedge funds been doing with The St. Joe Company (NYSE:JOE)?

At Q4’s end, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 11% from the third quarter of 2019. The graph below displays the number of hedge funds with bullish position in JOE over the last 18 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in The St. Joe Company (NYSE:JOE) was held by Fairholme (FAIRX), which reported holding $521.9 million worth of stock at the end of September. It was followed by GAMCO Investors with a $28 million position. Other investors bullish on the company included Renaissance Technologies, Royce & Associates, and Citadel Investment Group. In terms of the portfolio weights assigned to each position Fairholme (FAIRX) allocated the biggest weight to The St. Joe Company (NYSE:JOE), around 98.93% of its 13F portfolio. GAMCO Investors is also relatively very bullish on the stock, earmarking 0.22 percent of its 13F equity portfolio to JOE.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. PEAK6 Capital Management, managed by Matthew Hulsizer, established the most outsized position in The St. Joe Company (NYSE:JOE). PEAK6 Capital Management had $0.5 million invested in the company at the end of the quarter. D. E. Shaw’s D E Shaw also initiated a $0.2 million position during the quarter.

Let’s also examine hedge fund activity in other stocks similar to The St. Joe Company (NYSE:JOE). These stocks are Waddell & Reed Financial, Inc. (NYSE:WDR), KKR Real Estate Finance Trust Inc. (NYSE:KREF), Denny’s Corporation (NASDAQ:DENN), and Re/Max Holdings Inc (NYSE:RMAX). This group of stocks’ market caps are similar to JOE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WDR | 21 | 125127 | 1 |

| KREF | 9 | 38889 | -2 |

| DENN | 21 | 158298 | 0 |

| RMAX | 17 | 79279 | 7 |

| Average | 17 | 100398 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $100 million. That figure was $576 million in JOE’s case. Waddell & Reed Financial, Inc. (NYSE:WDR) is the most popular stock in this table. On the other hand KKR Real Estate Finance Trust Inc. (NYSE:KREF) is the least popular one with only 9 bullish hedge fund positions. The St. Joe Company (NYSE:JOE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 1.0% in 2020 through May 1st but beat the market by 12.9 percentage points. A small number of hedge funds were also right about betting on JOE, though not to the same extent, as the stock returned -11% during the same time period and outperformed the market.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.