We know that hedge funds generate strong, risk-adjusted returns over the long run, which is why imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, professional investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do. However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, let’s examine the smart money sentiment towards Telenav Inc (NASDAQ:TNAV) and determine whether hedge funds skillfully traded this stock.

Hedge fund interest in Telenav Inc (NASDAQ:TNAV) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare TNAV to other stocks including Rafael Holdings, Inc. (NYSE:RFL), Spok Holdings Inc (NASDAQ:SPOK), and Beazer Homes USA, Inc. (NYSE:BZH) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a lot of methods investors can use to value publicly traded companies. A duo of the less utilized methods are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can trounce the S&P 500 by a superb amount (see the details here).

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, we take a look at lists like the 10 most profitable companies in the world to identify emerging companies that are likely to deliver 1000% gains in the coming years. We interview hedge fund managers and ask them about their best ideas. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a gander at the fresh hedge fund action encompassing Telenav Inc (NASDAQ:TNAV).

What does smart money think about Telenav Inc (NASDAQ:TNAV)?

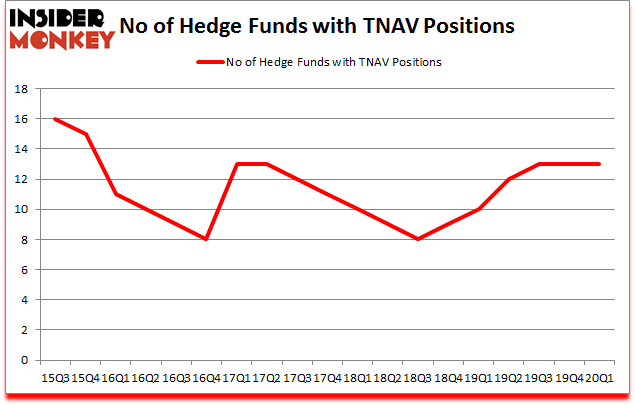

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the fourth quarter of 2019. By comparison, 10 hedge funds held shares or bullish call options in TNAV a year ago. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

The largest stake in Telenav Inc (NASDAQ:TNAV) was held by Nokomis Capital, which reported holding $20.7 million worth of stock at the end of September. It was followed by Divisar Capital with a $9.3 million position. Other investors bullish on the company included Renaissance Technologies, Arrowstreet Capital, and Citadel Investment Group. In terms of the portfolio weights assigned to each position Nokomis Capital allocated the biggest weight to Telenav Inc (NASDAQ:TNAV), around 9.95% of its 13F portfolio. Divisar Capital is also relatively very bullish on the stock, earmarking 3.65 percent of its 13F equity portfolio to TNAV.

Due to the fact that Telenav Inc (NASDAQ:TNAV) has witnessed a decline in interest from the aggregate hedge fund industry, logic holds that there were a few money managers who sold off their entire stakes heading into Q4. It’s worth mentioning that Israel Englander’s Millennium Management cut the biggest position of the 750 funds watched by Insider Monkey, comprising an estimated $4.2 million in stock. Paul Tudor Jones’s fund, Tudor Investment Corp, also dumped its stock, about $0.1 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Telenav Inc (NASDAQ:TNAV) but similarly valued. These stocks are Rafael Holdings, Inc. (NYSE:RFL), Spok Holdings Inc (NASDAQ:SPOK), Beazer Homes USA, Inc. (NYSE:BZH), and Irsa Inversiones y Rprsntcins SA (NYSE:IRS). This group of stocks’ market caps resemble TNAV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RFL | 5 | 23762 | -2 |

| SPOK | 13 | 22419 | 1 |

| BZH | 12 | 22450 | -2 |

| IRS | 6 | 13568 | 0 |

| Average | 9 | 20550 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $21 million. That figure was $46 million in TNAV’s case. Spok Holdings Inc (NASDAQ:SPOK) is the most popular stock in this table. On the other hand Rafael Holdings, Inc. (NYSE:RFL) is the least popular one with only 5 bullish hedge fund positions. Telenav Inc (NASDAQ:TNAV) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.3% in 2020 through June 25th but still beat the market by 16.8 percentage points. Hedge funds were also right about betting on TNAV, though not to the same extent, as the stock returned 24.3% during the first two months and twenty five days of the second quarter and outperformed the market as well.

Follow Telenav Inc. (NASDAQ:TNAV)

Follow Telenav Inc. (NASDAQ:TNAV)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.