Is Northrop Grumman Corporation (NYSE:NOC) a good bet right now? We like to analyze hedge fund sentiment before doing days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

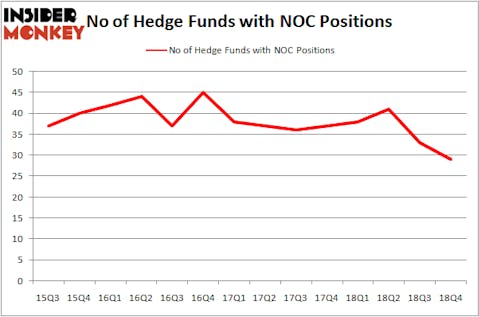

Northrop Grumman Corporation (NYSE:NOC) has seen a decrease in activity from the world’s largest hedge funds in recent months. NOC was in 29 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 33 hedge funds in our database with NOC positions at the end of the previous quarter. Our calculations also showed that NOC isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to review the latest hedge fund action encompassing Northrop Grumman Corporation (NYSE:NOC).

What have hedge funds been doing with Northrop Grumman Corporation (NYSE:NOC)?

At Q4’s end, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of -12% from one quarter earlier. On the other hand, there were a total of 38 hedge funds with a bullish position in NOC a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, AQR Capital Management, managed by Cliff Asness, holds the largest position in Northrop Grumman Corporation (NYSE:NOC). AQR Capital Management has a $166 million position in the stock, comprising 0.2% of its 13F portfolio. Coming in second is Millennium Management, managed by Israel Englander, which holds a $139.2 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other peers with similar optimism contain John Overdeck and David Siegel’s Two Sigma Advisors, Panayotis Takis Sparaggis’s Alkeon Capital Management and Ken Griffin’s Citadel Investment Group.

Seeing as Northrop Grumman Corporation (NYSE:NOC) has faced bearish sentiment from the entirety of the hedge funds we track, we can see that there exists a select few fund managers who were dropping their positions entirely last quarter. At the top of the heap, Philip Hilal’s Clearfield Capital dropped the biggest position of all the hedgies followed by Insider Monkey, worth about $50.9 million in stock. Steve Cohen’s fund, Point72 Asset Management, also said goodbye to its stock, about $46.9 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 4 funds last quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Northrop Grumman Corporation (NYSE:NOC) but similarly valued. These stocks are Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), FedEx Corporation (NYSE:FDX), Illinois Tool Works Inc. (NYSE:ITW), and Bank of Montreal (NYSE:BMO). This group of stocks’ market caps match NOC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VRTX | 39 | 2270792 | -2 |

| FDX | 41 | 2195802 | -1 |

| ITW | 28 | 293072 | 2 |

| BMO | 15 | 392379 | 2 |

| Average | 30.75 | 1288011 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.75 hedge funds with bullish positions and the average amount invested in these stocks was $1288 million. That figure was $645 million in NOC’s case. FedEx Corporation (NYSE:FDX) is the most popular stock in this table. On the other hand Bank of Montreal (NYSE:BMO) is the least popular one with only 15 bullish hedge fund positions. Northrop Grumman Corporation (NYSE:NOC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately NOC wasn’t in this group. Hedge funds that bet on NOC were disappointed as the stock returned 11.2% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.