A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended June 28, so let’s proceed with the discussion of the hedge fund sentiment on Neurocrine Biosciences, Inc. (NASDAQ:NBIX).

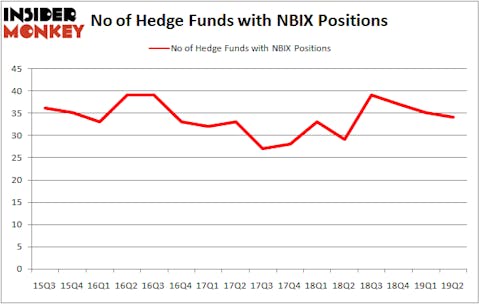

Neurocrine Biosciences, Inc. (NASDAQ:NBIX) was in 34 hedge funds’ portfolios at the end of the second quarter of 2019. NBIX investors should pay attention to a decrease in enthusiasm from smart money lately. There were 35 hedge funds in our database with NBIX positions at the end of the previous quarter. Our calculations also showed that NBIX isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most stock holders, hedge funds are viewed as underperforming, outdated investment tools of the past. While there are more than 8000 funds in operation at the moment, Our researchers hone in on the leaders of this club, around 750 funds. These hedge fund managers command bulk of the smart money’s total asset base, and by monitoring their first-class equity investments, Insider Monkey has formulated numerous investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points annually since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a glance at the latest hedge fund action surrounding Neurocrine Biosciences, Inc. (NASDAQ:NBIX).

How are hedge funds trading Neurocrine Biosciences, Inc. (NASDAQ:NBIX)?

At the end of the second quarter, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of -3% from one quarter earlier. By comparison, 29 hedge funds held shares or bullish call options in NBIX a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Joseph Edelman’s Perceptive Advisors has the largest position in Neurocrine Biosciences, Inc. (NASDAQ:NBIX), worth close to $339.7 million, comprising 7.8% of its total 13F portfolio. Sitting at the No. 2 spot is Arthur B Cohen and Joseph Healey of Healthcor Management LP, with a $200.2 million position; 7.8% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that hold long positions include Samuel Isaly’s OrbiMed Advisors, Julian Baker and Felix Baker’s Baker Bros. Advisors and Steve Cohen’s Point72 Asset Management.

Since Neurocrine Biosciences, Inc. (NASDAQ:NBIX) has faced falling interest from the smart money, we can see that there is a sect of hedge funds who were dropping their full holdings by the end of the second quarter. Intriguingly, Paul Marshall and Ian Wace’s Marshall Wace LLP cut the largest investment of the 750 funds watched by Insider Monkey, totaling an estimated $33 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund said goodbye to about $8.8 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 1 funds by the end of the second quarter.

Let’s also examine hedge fund activity in other stocks similar to Neurocrine Biosciences, Inc. (NASDAQ:NBIX). We will take a look at Kohl’s Corporation (NYSE:KSS), Kilroy Realty Corp (NYSE:KRC), The Middleby Corporation (NASDAQ:MIDD), and Momo Inc (NASDAQ:MOMO). This group of stocks’ market values match NBIX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KSS | 29 | 550214 | 2 |

| KRC | 16 | 161727 | 5 |

| MIDD | 27 | 554379 | 7 |

| MOMO | 22 | 855304 | 1 |

| Average | 23.5 | 530406 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $530 million. That figure was $1237 million in NBIX’s case. Kohl’s Corporation (NYSE:KSS) is the most popular stock in this table. On the other hand Kilroy Realty Corp (NYSE:KRC) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks Neurocrine Biosciences, Inc. (NASDAQ:NBIX) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on NBIX as the stock returned 6.7% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.