We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Keeping this in mind, let’s take a look at whether McGrath RentCorp (NASDAQ:MGRC) is a good investment right now. We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

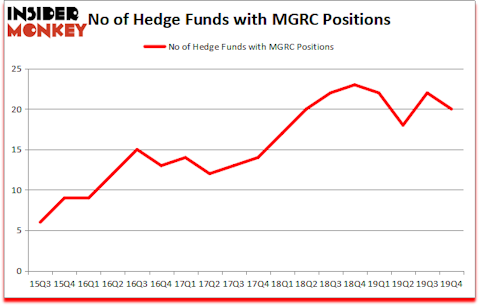

Is McGrath RentCorp (NASDAQ:MGRC) a bargain? The best stock pickers are taking a bearish view. The number of long hedge fund positions retreated by 2 lately. Our calculations also showed that MGRC isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Chuck Royce of Royce & Associates

Now let’s view the fresh hedge fund action surrounding McGrath RentCorp (NASDAQ:MGRC).

Hedge fund activity in McGrath RentCorp (NASDAQ:MGRC)

At Q4’s end, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from one quarter earlier. By comparison, 23 hedge funds held shares or bullish call options in MGRC a year ago. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in McGrath RentCorp (NASDAQ:MGRC), which was worth $30.8 million at the end of the third quarter. On the second spot was SG Capital Management which amassed $22.2 million worth of shares. Headlands Capital, Royce & Associates, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Headlands Capital allocated the biggest weight to McGrath RentCorp (NASDAQ:MGRC), around 12.23% of its 13F portfolio. SG Capital Management is also relatively very bullish on the stock, setting aside 4.37 percent of its 13F equity portfolio to MGRC.

Since McGrath RentCorp (NASDAQ:MGRC) has witnessed a decline in interest from the aggregate hedge fund industry, it’s easy to see that there exists a select few hedge funds who sold off their positions entirely by the end of the third quarter. Intriguingly, Minhua Zhang’s Weld Capital Management dropped the biggest investment of the “upper crust” of funds monitored by Insider Monkey, comprising an estimated $0.7 million in stock, and Paul Tudor Jones’s Tudor Investment Corp was right behind this move, as the fund dumped about $0.6 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest was cut by 2 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to McGrath RentCorp (NASDAQ:MGRC). These stocks are O-I Glass, Inc. (NYSE:OI), Axos Financial, Inc. (NYSE:AX), Jack in the Box Inc. (NASDAQ:JACK), and OSI Systems, Inc. (NASDAQ:OSIS). All of these stocks’ market caps are similar to MGRC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OI | 20 | 504837 | -4 |

| AX | 15 | 70849 | 0 |

| JACK | 26 | 288965 | -4 |

| OSIS | 20 | 90282 | -5 |

| Average | 20.25 | 238733 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $239 million. That figure was $150 million in MGRC’s case. Jack in the Box Inc. (NASDAQ:JACK) is the most popular stock in this table. On the other hand Axos Financial, Inc. (NYSE:AX) is the least popular one with only 15 bullish hedge fund positions. McGrath RentCorp (NASDAQ:MGRC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but beat the market by 4.2 percentage points. Unfortunately MGRC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); MGRC investors were disappointed as the stock returned -28.9% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.