In this article we will take a look at whether hedge funds think Bed Bath & Beyond Inc. (NASDAQ:BBBY) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

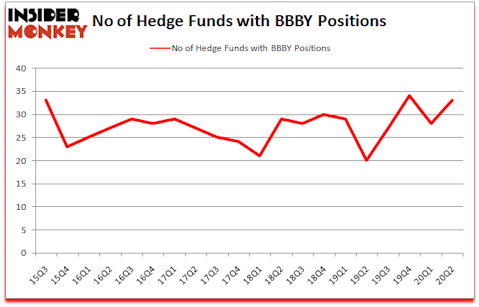

Is Bed Bath & Beyond Inc. (NASDAQ:BBBY) worth your attention right now? The best stock pickers were becoming hopeful. The number of long hedge fund positions went up by 5 recently. Bed Bath & Beyond Inc. (NASDAQ:BBBY) was in 33 hedge funds’ portfolios at the end of June. The all time high for this statistics is 34. Our calculations also showed that BBBY isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 28 hedge funds in our database with BBBY positions at the end of the first quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most shareholders, hedge funds are seen as slow, outdated investment tools of the past. While there are more than 8000 funds trading today, We hone in on the top tier of this club, around 850 funds. Most estimates calculate that this group of people shepherd the lion’s share of the hedge fund industry’s total capital, and by keeping track of their first-class equity investments, Insider Monkey has found a number of investment strategies that have historically outperformed the market. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Last week, most investors overlooked a major development because of the presidential elections: Oregon became the first state to legalize psychedelic mushrooms which are shown to have promising results in treating depression, addiction, and PTSD in early stage academic studies. So, we are checking out this psychedelic drug stock idea right now. We go through lists like the 10 best high dividend stocks to buy to identify high dividend stocks with upside potential in this low interest rate environment. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind we’re going to take a look at the recent hedge fund action surrounding Bed Bath & Beyond Inc. (NASDAQ:BBBY).

What does smart money think about Bed Bath & Beyond Inc. (NASDAQ:BBBY)?

Heading into the third quarter of 2020, a total of 33 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards BBBY over the last 20 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Contrarius Investment Management was the largest shareholder of Bed Bath & Beyond Inc. (NASDAQ:BBBY), with a stake worth $108.3 million reported as of the end of June. Trailing Contrarius Investment Management was Legion Partners Asset Management, which amassed a stake valued at $60.8 million. Arrowstreet Capital, Citadel Investment Group, and Junto Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Legion Partners Asset Management allocated the biggest weight to Bed Bath & Beyond Inc. (NASDAQ:BBBY), around 17.01% of its 13F portfolio. Contrarius Investment Management is also relatively very bullish on the stock, setting aside 10.23 percent of its 13F equity portfolio to BBBY.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Junto Capital Management, managed by James Parsons, created the largest position in Bed Bath & Beyond Inc. (NASDAQ:BBBY). Junto Capital Management had $22.7 million invested in the company at the end of the quarter. Michael Burry’s Scion Asset Management also made a $10.6 million investment in the stock during the quarter. The other funds with new positions in the stock are Michael Zimmerman’s Prentice Capital Management, Frank Brosens’s Taconic Capital, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Bed Bath & Beyond Inc. (NASDAQ:BBBY) but similarly valued. These stocks are Weis Markets, Inc. (NYSE:WMK), NGM Biopharmaceuticals, Inc. (NASDAQ:NGM), NBT Bancorp Inc. (NASDAQ:NBTB), OSI Systems, Inc. (NASDAQ:OSIS), Industrial Logistics Properties Trust (NASDAQ:ILPT), Black Stone Minerals LP (NYSE:BSM), and Banner Corporation (NASDAQ:BANR). This group of stocks’ market values are closest to BBBY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WMK | 19 | 51204 | 7 |

| NGM | 12 | 106170 | 0 |

| NBTB | 9 | 14109 | 5 |

| OSIS | 13 | 29529 | -2 |

| ILPT | 9 | 50520 | 0 |

| BSM | 5 | 6083 | 2 |

| BANR | 14 | 49095 | -1 |

| Average | 11.6 | 43816 | 1.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.6 hedge funds with bullish positions and the average amount invested in these stocks was $44 million. That figure was $351 million in BBBY’s case. Weis Markets, Inc. (NYSE:WMK) is the most popular stock in this table. On the other hand Black Stone Minerals LP (NYSE:BSM) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Bed Bath & Beyond Inc. (NASDAQ:BBBY) is more popular among hedge funds. Our overall hedge fund sentiment score for BBBY is 89.1. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 23% in 2020 through October 30th but still managed to beat the market by 20.1 percentage points. Hedge funds were also right about betting on BBBY as the stock returned 86.8% since the end of June (through 10/30) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Bed Bath & Beyond Inc (NASDAQ:BBBY)

Follow Bed Bath & Beyond Inc (NASDAQ:BBBY)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.