Hedge fund managers like David Einhorn, Bill Ackman, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Las Vegas Sands Corp. (NYSE:LVS).

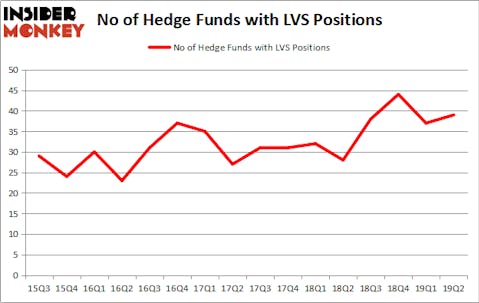

Is Las Vegas Sands Corp. (NYSE:LVS) worth your attention right now? The best stock pickers are taking a bullish view. The number of long hedge fund bets moved up by 2 recently. Our calculations also showed that LVS isn’t among the 30 most popular stocks among hedge funds (see the video below). LVS was in 39 hedge funds’ portfolios at the end of the second quarter of 2019. There were 37 hedge funds in our database with LVS positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a multitude of signals investors have at their disposal to analyze their stock investments. Some of the most underrated signals are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the elite money managers can outclass the broader indices by a healthy margin (see the details here).

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the latest hedge fund action surrounding Las Vegas Sands Corp. (NYSE:LVS).

How are hedge funds trading Las Vegas Sands Corp. (NYSE:LVS)?

Heading into the third quarter of 2019, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from the previous quarter. By comparison, 28 hedge funds held shares or bullish call options in LVS a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Las Vegas Sands Corp. (NYSE:LVS) was held by Melvin Capital Management, which reported holding $458.3 million worth of stock at the end of March. It was followed by D1 Capital Partners with a $230.5 million position. Other investors bullish on the company included Citadel Investment Group, D E Shaw, and Renaissance Technologies.

Consequently, specific money managers have jumped into Las Vegas Sands Corp. (NYSE:LVS) headfirst. Maplelane Capital, managed by Leon Shaulov, established the most outsized call position in Las Vegas Sands Corp. (NYSE:LVS). Maplelane Capital had $106.4 million invested in the company at the end of the quarter. Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners also initiated a $70.3 million position during the quarter. The following funds were also among the new LVS investors: Steve Cohen’s Point72 Asset Management, Dmitry Balyasny’s Balyasny Asset Management, and Matthew Knauer and Mina Faltas’s Nokota Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Las Vegas Sands Corp. (NYSE:LVS) but similarly valued. We will take a look at Metlife Inc (NYSE:MET), Kinder Morgan Inc (NYSE:KMI), Exelon Corporation (NASDAQ:EXC), and Aon plc (NYSE:AON). This group of stocks’ market valuations match LVS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MET | 26 | 1498576 | -5 |

| KMI | 37 | 1685778 | 1 |

| EXC | 32 | 1990186 | -1 |

| AON | 34 | 2527721 | -5 |

| Average | 32.25 | 1925565 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.25 hedge funds with bullish positions and the average amount invested in these stocks was $1926 million. That figure was $1883 million in LVS’s case. Kinder Morgan Inc (NYSE:KMI) is the most popular stock in this table. On the other hand Metlife Inc (NYSE:MET) is the least popular one with only 26 bullish hedge fund positions. Compared to these stocks Las Vegas Sands Corp. (NYSE:LVS) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately LVS wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on LVS were disappointed as the stock returned -1% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.