“I have been following Dr. Inan Dogan since this outbreak, and he is a phenomenally intelligent researcher. One month ago, Dr. Dogan’s prediction that the total U.S. death toll would be 20,000+ by April 15th was deemed “radical”. His Recession is Imminent article in February was very timely. Now he believes we could quickly end lockdowns in NYC after some simple testing. A must read” were the words used by our readers to describe our latest article.

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. With this in mind let’s see whether Harsco Corporation (NYSE:HSC) makes for a good investment at the moment. We analyze the sentiment of a select group of the very best investors in the world, who spend immense amounts of time and resources studying companies. They may not always be right (no one is), but data shows that their consensus long positions have historically outperformed the market when we adjust for known risk factors.

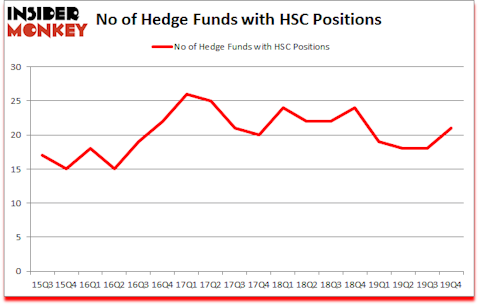

Harsco Corporation (NYSE:HSC) was in 21 hedge funds’ portfolios at the end of December. HSC shareholders have witnessed an increase in activity from the world’s largest hedge funds lately. There were 18 hedge funds in our database with HSC positions at the end of the previous quarter. Our calculations also showed that HSC isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by more than 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 35.3% through March 3rd. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We leave no stone unturned when looking for the next great investment idea. For example, Federal Reserve and other Central Banks are tripping over each other to print more money. As a result, we believe gold stocks will outperform fixed income ETFs in the long-term. So we are checking out investment opportunities like this one. We are probably at the peak of the COVID-19 pandemic, so we check out this biotech investor’s coronavirus picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences (by the way watch this video if you want to hear one of the best healthcare hedge fund manager’s coronavirus analysis). Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s take a look at the latest hedge fund action regarding Harsco Corporation (NYSE:HSC).

What does smart money think about Harsco Corporation (NYSE:HSC)?

At the end of the fourth quarter, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 17% from the third quarter of 2019. On the other hand, there were a total of 24 hedge funds with a bullish position in HSC a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Adage Capital Management was the largest shareholder of Harsco Corporation (NYSE:HSC), with a stake worth $60.7 million reported as of the end of September. Trailing Adage Capital Management was Encompass Capital Advisors, which amassed a stake valued at $33.7 million. Millennium Management, Scopus Asset Management, and Arrowstreet Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Harvey Partners allocated the biggest weight to Harsco Corporation (NYSE:HSC), around 3.12% of its 13F portfolio. Encompass Capital Advisors is also relatively very bullish on the stock, earmarking 2.15 percent of its 13F equity portfolio to HSC.

Consequently, key money managers were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the largest position in Harsco Corporation (NYSE:HSC). Arrowstreet Capital had $11.8 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $8.9 million position during the quarter. The following funds were also among the new HSC investors: Paul Marshall and Ian Wace’s Marshall Wace LLP, Noam Gottesman’s GLG Partners, and Robert Vincent McHugh’s Jade Capital Advisors.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Harsco Corporation (NYSE:HSC) but similarly valued. These stocks are Mueller Industries, Inc. (NYSE:MLI), PagerDuty, Inc. (NYSE:PD), Vonage Holdings Corp. (NASDAQ:VG), and Diversified Healthcare Trust (NASDAQ:SNH). This group of stocks’ market caps are closest to HSC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MLI | 21 | 215236 | 2 |

| PD | 15 | 33030 | 4 |

| VG | 35 | 269101 | 2 |

| SNH | 9 | 32625 | -4 |

| Average | 20 | 137498 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $137 million. That figure was $182 million in HSC’s case. Vonage Holdings Corp. (NASDAQ:VG) is the most popular stock in this table. On the other hand Diversified Healthcare Trust (NASDAQ:SNH) is the least popular one with only 9 bullish hedge fund positions. Harsco Corporation (NYSE:HSC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but beat the market by 4.2 percentage points. Unfortunately HSC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on HSC were disappointed as the stock returned -71.3% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.