Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost a third of its value since the end of July. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 S&P 500 stocks among hedge funds at the end of September 2018 yielded an average return of 6.7% year-to-date, vs. a gain of 2.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Harsco Corporation (NYSE:HSC).

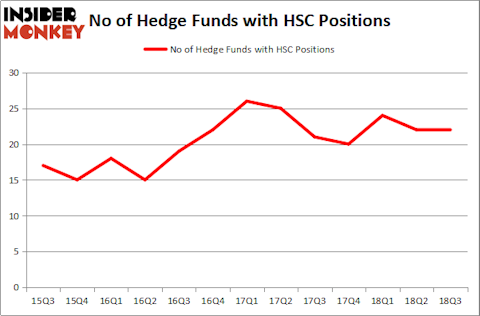

Harsco Corporation (NYSE:HSC) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 22 hedge funds’ portfolios at the end of the third quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Meredith Corporation (NYSE:MDP), BEST Inc. (NYSE:BSTI), and Callaway Golf Company (NYSE:ELY) to gather more data points.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s check out the recent hedge fund action regarding Harsco Corporation (NYSE:HSC).

How are hedge funds trading Harsco Corporation (NYSE:HSC)?

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, no change from one quarter earlier. On the other hand, there were a total of 20 hedge funds with a bullish position in HSC at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Harsco Corporation (NYSE:HSC) was held by SG Capital Management, which reported holding $36.7 million worth of stock at the end of September. It was followed by Adage Capital Management with a $20.1 million position. Other investors bullish on the company included 1060 Capital Management, Columbus Circle Investors, and GLG Partners.

Seeing as Harsco Corporation (NYSE:HSC) has witnessed declining sentiment from the aggregate hedge fund industry, it’s easy to see that there is a sect of hedge funds that slashed their entire stakes in the third quarter. Interestingly, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital said goodbye to the biggest investment of the “upper crust” of funds watched by Insider Monkey, worth about $0.6 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also said goodbye to its stock, about $0.4 million worth. These moves are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Harsco Corporation (NYSE:HSC) but similarly valued. We will take a look at Meredith Corporation (NYSE:MDP), BEST Inc. (NYSE:BSTI), Callaway Golf Company (NYSE:ELY), and Cavco Industries, Inc. (NASDAQ:CVCO). This group of stocks’ market values are closest to HSC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MDP | 17 | 311204 | 5 |

| BSTI | 12 | 53685 | 2 |

| ELY | 27 | 218969 | 1 |

| CVCO | 19 | 207373 | -1 |

| Average | 18.75 | 197808 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $198 million. That figure was $134 million in HSC’s case. Callaway Golf Company (NYSE:ELY) is the most popular stock in this table. On the other hand BEST Inc. (NYSE:BSTI) is the least popular one with only 12 bullish hedge fund positions. Harsco Corporation (NYSE:HSC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ELY might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.