We hate to say this but, we told you so. On February 27th we published an article with the title Recession is Imminent: We Need A Travel Ban NOW and predicted a US recession when the S&P 500 Index was trading at the 3150 level. We also told you to short the market and buy long-term Treasury bonds. Our article also called for a total international travel ban. While we were warning you, President Trump minimized the threat and failed to act promptly. As a result of his inaction, we will now experience a deeper recession (see why hell is coming).

In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Gray Television, Inc. (NYSE:GTN).

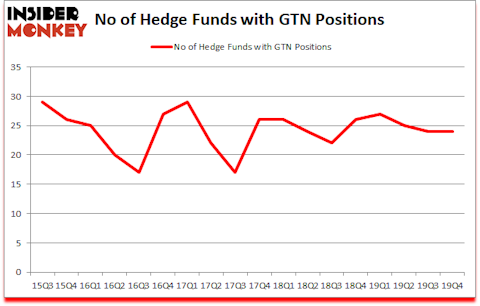

Gray Television, Inc. (NYSE:GTN) shares haven’t seen a lot of action during the fourth quarter. Overall, hedge fund sentiment was unchanged. The stock was in 24 hedge funds’ portfolios at the end of the fourth quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Eidos Therapeutics, Inc. (NASDAQ:EIDX), Freshpet Inc (NASDAQ:FRPT), and Sally Beauty Holdings, Inc. (NYSE:SBH) to gather more data points. Our calculations also showed that GTN isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video at the end of this article for Q3 rankings).

Today there are a large number of formulas stock market investors put to use to assess their holdings. A couple of the less known formulas are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can beat the S&P 500 by a healthy amount (see the details here).

Leon Cooperman of Omega Advisors

With all of this in mind we’re going to take a look at the latest hedge fund action surrounding Gray Television, Inc. (NYSE:GTN).

Hedge fund activity in Gray Television, Inc. (NYSE:GTN)

Heading into the first quarter of 2020, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards GTN over the last 18 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Darsana Capital Partners, managed by Anand Desai, holds the biggest position in Gray Television, Inc. (NYSE:GTN). Darsana Capital Partners has a $171.5 million position in the stock, comprising 5.8% of its 13F portfolio. Coming in second is Omega Advisors, managed by Leon Cooperman, which holds a $12.9 million position; 0.7% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that hold long positions contain Israel Englander’s Millennium Management, Mario Gabelli’s GAMCO Investors and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. In terms of the portfolio weights assigned to each position Darsana Capital Partners allocated the biggest weight to Gray Television, Inc. (NYSE:GTN), around 5.85% of its 13F portfolio. Act II Capital is also relatively very bullish on the stock, setting aside 3.57 percent of its 13F equity portfolio to GTN.

Because Gray Television, Inc. (NYSE:GTN) has witnessed declining sentiment from the aggregate hedge fund industry, it’s easy to see that there is a sect of money managers that slashed their full holdings last quarter. Intriguingly, Ken Griffin’s Citadel Investment Group sold off the biggest position of all the hedgies monitored by Insider Monkey, totaling about $4.1 million in stock. Sander Gerber’s fund, Hudson Bay Capital Management, also sold off its stock, about $3.5 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to Gray Television, Inc. (NYSE:GTN). We will take a look at Eidos Therapeutics, Inc. (NASDAQ:EIDX), Freshpet Inc (NASDAQ:FRPT), Sally Beauty Holdings, Inc. (NYSE:SBH), and Insmed Incorporated (NASDAQ:INSM). All of these stocks’ market caps are similar to GTN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EIDX | 20 | 312421 | 5 |

| FRPT | 20 | 122100 | 2 |

| SBH | 27 | 205932 | 3 |

| INSM | 25 | 489521 | 2 |

| Average | 23 | 282494 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $282 million. That figure was $253 million in GTN’s case. Sally Beauty Holdings, Inc. (NYSE:SBH) is the most popular stock in this table. On the other hand Eidos Therapeutics, Inc. (NASDAQ:EIDX) is the least popular one with only 20 bullish hedge fund positions. Gray Television, Inc. (NYSE:GTN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 13.0% in 2020 through April 6th but beat the market by 4.2 percentage points. Unfortunately GTN wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on GTN were disappointed as the stock returned -50% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.