At Insider Monkey, we pore over the filings of more than 700 top investment firms every quarter, a process we have now completed for the latest reporting period. The data we’ve gathered as a result gives us access to a wealth of collective knowledge based on these firms’ portfolio holdings as of September 30. In this article, we will use that wealth of knowledge to determine whether or not Gray Television, Inc. (NYSE:GTN) makes for a good investment right now.

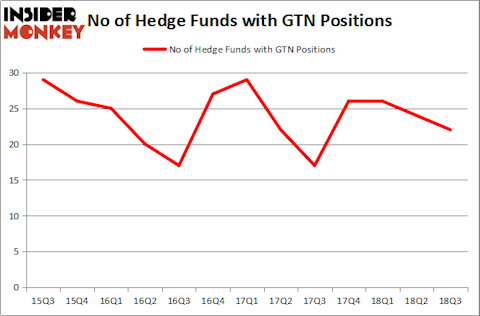

Is Gray Television, Inc. (NYSE:GTN) a buy right now? The best stock pickers are taking a pessimistic view. The number of bullish hedge fund positions shrunk by 2 recently. Our calculations also showed that GTN isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s review the new hedge fund action encompassing Gray Television, Inc. (NYSE:GTN).

Hedge fund activity in Gray Television, Inc. (NYSE:GTN)

Heading into the fourth quarter of 2018, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of -8% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards GTN over the last 13 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Anand Desai’s Darsana Capital Partners has the biggest position in Gray Television, Inc. (NYSE:GTN), worth close to $140 million, amounting to 4.4% of its total 13F portfolio. Sitting at the No. 2 spot is Three Bays Capital, managed by Matthew Sidman, which holds a $39 million position; 4.6% of its 13F portfolio is allocated to the company. Remaining professional money managers that are bullish include Steve Ketchum’s Sound Point Capital, Israel Englander’s Millennium Management and Mario Gabelli’s GAMCO Investors.

Due to the fact that Gray Television, Inc. (NYSE:GTN) has experienced bearish sentiment from the smart money, it’s safe to say that there was a specific group of funds who were dropping their full holdings last quarter. It’s worth mentioning that Alexander Mitchell’s Scopus Asset Management sold off the largest investment of the “upper crust” of funds watched by Insider Monkey, worth close to $13.4 million in stock, and Bart Baum’s Ionic Capital Management was right behind this move, as the fund said goodbye to about $2.6 million worth. These moves are interesting, as total hedge fund interest fell by 2 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Gray Television, Inc. (NYSE:GTN) but similarly valued. We will take a look at Innoviva, Inc. (NASDAQ:INVA), Mazor Robotics Ltd. (NASDAQ:MZOR), Badger Meter, Inc. (NYSE:BMI), and Criteo SA (NASDAQ:CRTO). This group of stocks’ market values match GTN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INVA | 22 | 220079 | -2 |

| MZOR | 8 | 10500 | 2 |

| BMI | 9 | 107161 | 3 |

| CRTO | 11 | 176343 | 3 |

| Average | 12.5 | 128521 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $129 million. That figure was $262 million in GTN’s case. Innoviva, Inc. (NASDAQ:INVA) is the most popular stock in this table. On the other hand Mazor Robotics Ltd. (NASDAQ:MZOR) is the least popular one with only 8 bullish hedge fund positions. Gray Television, Inc. (NYSE:GTN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard INVA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.