Hedge fund managers like David Einhorn, Bill Ackman, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: QEP Resources Inc (NYSE:QEP).

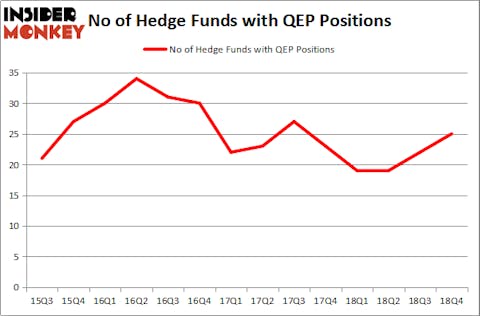

Is QEP Resources Inc (NYSE:QEP) a healthy stock for your portfolio? Hedge funds are in an optimistic mood. The number of bullish hedge fund bets went up by 3 lately. Our calculations also showed that QEP isn’t among the 30 most popular stocks among hedge funds. QEP was in 25 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 22 hedge funds in our database with QEP holdings at the end of the previous quarter.

At the moment there are tons of signals stock market investors use to assess publicly traded companies. Two of the most useful signals are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the top investment managers can outpace the market by a superb margin (see the details here).

Let’s go over the new hedge fund action encompassing QEP Resources Inc (NYSE:QEP).

What does the smart money think about QEP Resources Inc (NYSE:QEP)?

At Q4’s end, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of 14% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in QEP over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Elliott Management, managed by Paul Singer, holds the biggest position in QEP Resources Inc (NYSE:QEP). Elliott Management has a $65.9 million position in the stock, comprising 0.5% of its 13F portfolio. The second most bullish fund manager is D E Shaw, managed by D. E. Shaw, which holds a $44.3 million position; 0.1% of its 13F portfolio is allocated to the company. Other members of the smart money with similar optimism consist of Steve Cohen’s Point72 Asset Management, Steven Richman’s East Side Capital (RR Partners) and Cliff Asness’s AQR Capital Management.

Consequently, key hedge funds have been driving this bullishness. Renaissance Technologies, managed by Jim Simons, created the largest position in QEP Resources Inc (NYSE:QEP). Renaissance Technologies had $5.7 million invested in the company at the end of the quarter. Didric Cederholm’s Lion Point also made a $3.9 million investment in the stock during the quarter. The other funds with brand new QEP positions are Dmitry Balyasny’s Balyasny Asset Management, John Overdeck and David Siegel’s Two Sigma Advisors, and George McCabe’s Portolan Capital Management.

Let’s go over hedge fund activity in other stocks similar to QEP Resources Inc (NYSE:QEP). We will take a look at Chesapeake Utilities Corporation (NYSE:CPK), Revlon Inc (NYSE:REV), Ebix Inc (NASDAQ:EBIX), and Seacoast Banking Corporation of Florida (NASDAQ:SBCF). This group of stocks’ market values resemble QEP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CPK | 10 | 34548 | 1 |

| REV | 26 | 180187 | 0 |

| EBIX | 18 | 133327 | 2 |

| SBCF | 6 | 44504 | -3 |

| Average | 15 | 98142 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $98 million. That figure was $219 million in QEP’s case. Revlon Inc (NYSE:REV) is the most popular stock in this table. On the other hand Seacoast Banking Corporation of Florida (NASDAQ:SBCF) is the least popular one with only 6 bullish hedge fund positions. QEP Resources Inc (NYSE:QEP) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on QEP as the stock returned 43.5% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.