Is KBR, Inc. (NYSE:KBR) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

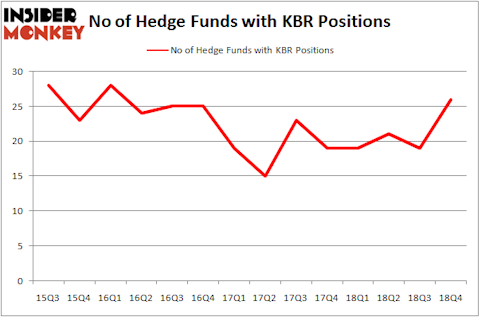

KBR, Inc. (NYSE:KBR) shareholders have witnessed an increase in hedge fund sentiment in recent months. KBR was in 26 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 19 hedge funds in our database with KBR holdings at the end of the previous quarter. Our calculations also showed that KBR isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Arnaud Ajdler Engine Capital

Let’s review the new hedge fund action regarding KBR, Inc. (NYSE:KBR).

How have hedgies been trading KBR, Inc. (NYSE:KBR)?

At the end of the fourth quarter, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 37% from the previous quarter. On the other hand, there were a total of 19 hedge funds with a bullish position in KBR a year ago. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

The largest stake in KBR, Inc. (NYSE:KBR) was held by Huber Capital Management, which reported holding $75.3 million worth of stock at the end of September. It was followed by Pzena Investment Management with a $71.8 million position. Other investors bullish on the company included Citadel Investment Group, AQR Capital Management, and Millennium Management.

With a general bullishness amongst the heavyweights, key money managers have jumped into KBR, Inc. (NYSE:KBR) headfirst. Shellback Capital, managed by Doug Gordon, Jon Hilsabeck and Don Jabro, created the most valuable position in KBR, Inc. (NYSE:KBR). Shellback Capital had $14.5 million invested in the company at the end of the quarter. Clint Carlson’s Carlson Capital also initiated a $13.8 million position during the quarter. The following funds were also among the new KBR investors: Arnaud Ajdler’s Engine Capital, Nick Niell’s Arrowgrass Capital Partners, and Glenn Russell Dubin’s Highbridge Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to KBR, Inc. (NYSE:KBR). We will take a look at PotlatchDeltic Corporation (NASDAQ:PCH), The Michaels Companies, Inc. (NASDAQ:MIK), Nelnet, Inc. (NYSE:NNI), and Avanos Medical, Inc. (NYSE:AVNS). All of these stocks’ market caps resemble KBR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PCH | 15 | 279786 | -1 |

| MIK | 30 | 255528 | 4 |

| NNI | 14 | 68393 | -1 |

| AVNS | 14 | 45065 | -3 |

| Average | 18.25 | 162193 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $162 million. That figure was $345 million in KBR’s case. The Michaels Companies, Inc. (NASDAQ:MIK) is the most popular stock in this table. On the other hand Nelnet, Inc. (NYSE:NNI) is the least popular one with only 14 bullish hedge fund positions. KBR, Inc. (NYSE:KBR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on KBR as the stock returned 46.5% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.