Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 13.1% in the 2.5 months of 2019 (including dividend payments). Conversely, hedge funds’ 15 preferred S&P 500 stocks generated a return of 19.7% during the same period, with 93% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like JD.Com Inc (NASDAQ:JD).

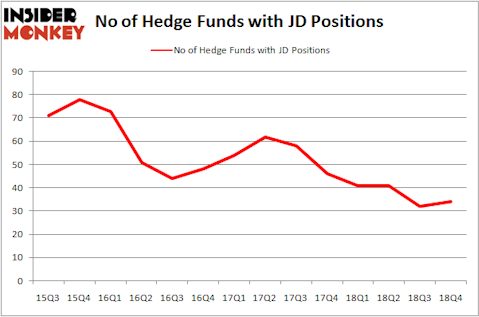

Is JD.Com Inc (NASDAQ:JD) going to take off soon? Money managers are turning bullish. The number of bullish hedge fund positions rose by 2 recently. Our calculations also showed that JD isn’t among the 30 most popular stocks among hedge funds. JD was in 34 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 32 hedge funds in our database with JD positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a peek at the key hedge fund action surrounding JD.Com Inc (NASDAQ:JD).

How have hedgies been trading JD.Com Inc (NASDAQ:JD)?

Heading into the first quarter of 2019, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 6% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in JD over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in JD.Com Inc (NASDAQ:JD) was held by Tiger Global Management LLC, which reported holding $1212.3 million worth of stock at the end of September. It was followed by Fisher Asset Management with a $231.3 million position. Other investors bullish on the company included Alkeon Capital Management, First Pacific Advisors LLC, and Scopia Capital.

Now, key money managers were breaking ground themselves. Whale Rock Capital Management, managed by Alex Sacerdote, established the biggest position in JD.Com Inc (NASDAQ:JD). Whale Rock Capital Management had $61.2 million invested in the company at the end of the quarter. Jonathan Guo’s Yiheng Capital also initiated a $49 million position during the quarter. The other funds with new positions in the stock are Yi Xin’s Ariose Capital, James Dinan’s York Capital Management, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as JD.Com Inc (NASDAQ:JD) but similarly valued. These stocks are BT Group plc (NYSE:BT), Canon Inc. (NYSE:CAJ), Eaton Corporation plc (NYSE:ETN), and Sempra Energy (NYSE:SRE). All of these stocks’ market caps are similar to JD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BT | 9 | 17627 | 3 |

| CAJ | 6 | 84612 | -2 |

| ETN | 30 | 668932 | -8 |

| SRE | 34 | 2604018 | 1 |

| Average | 19.75 | 843797 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $844 million. That figure was $2227 million in JD’s case. Sempra Energy (NYSE:SRE) is the most popular stock in this table. On the other hand Canon Inc. (NYSE:CAJ) is the least popular one with only 6 bullish hedge fund positions. JD.Com Inc (NASDAQ:JD) is not the most popular stock in this group but hedge fund interest is still above average and saw an uptick in Q4. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on JD as the stock returned 33.4% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.