Is Etsy Inc (NASDAQ:ETSY) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

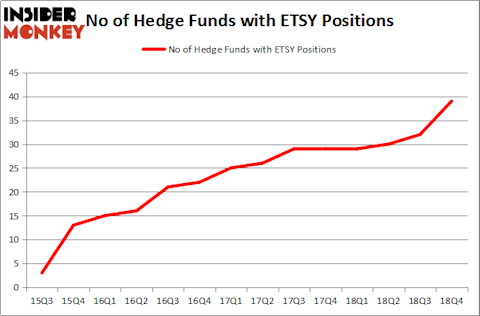

Is Etsy Inc (NASDAQ:ETSY) an excellent investment right now? The smart money is buying. The number of bullish hedge fund bets moved up by 7 in recent months. Our calculations also showed that ETSY isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a peek at the new hedge fund action encompassing Etsy Inc (NASDAQ:ETSY).

What have hedge funds been doing with Etsy Inc (NASDAQ:ETSY)?

Heading into the first quarter of 2019, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 22% from one quarter earlier. By comparison, 29 hedge funds held shares or bullish call options in ETSY a year ago. With the smart money’s sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jim Simons’s Renaissance Technologies has the biggest position in Etsy Inc (NASDAQ:ETSY), worth close to $325.6 million, corresponding to 0.4% of its total 13F portfolio. The second largest stake is held by D E Shaw, led by D. E. Shaw, holding a $142.8 million position; 0.2% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that are bullish encompass John Overdeck and David Siegel’s Two Sigma Advisors, Principal Global Investors’s Columbus Circle Investors and Edward Goodnow’s Goodnow Investment Group.

Now, some big names have been driving this bullishness. Millennium Management, managed by Israel Englander, initiated the most valuable position in Etsy Inc (NASDAQ:ETSY). Millennium Management had $34 million invested in the company at the end of the quarter. Bruce Garelick’s Garelick Capital Partners also made a $8.4 million investment in the stock during the quarter. The other funds with brand new ETSY positions are Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, Nehal Chopra’s Ratan Capital Group, and Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s also examine hedge fund activity in other stocks similar to Etsy Inc (NASDAQ:ETSY). These stocks are Five Below Inc (NASDAQ:FIVE), Michael Kors Holdings Ltd (NYSE:KORS), Allison Transmission Holdings Inc (NYSE:ALSN), and Masimo Corporation (NASDAQ:MASI). All of these stocks’ market caps are similar to ETSY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FIVE | 32 | 388480 | 6 |

| KORS | 33 | 758100 | -14 |

| ALSN | 26 | 1225431 | 2 |

| MASI | 33 | 461739 | 5 |

| Average | 31 | 708438 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 31 hedge funds with bullish positions and the average amount invested in these stocks was $708 million. That figure was $885 million in ETSY’s case. Michael Kors Holdings Ltd (NYSE:KORS) is the most popular stock in this table. On the other hand Allison Transmission Holdings Inc (NYSE:ALSN) is the least popular one with only 26 bullish hedge fund positions. Compared to these stocks Etsy Inc (NASDAQ:ETSY) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on Microsoft as the stock returned 42.2% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.