The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their March 31 holdings, data that is available nowhere else. Should you consider Cognizant Technology Solutions Corp (NASDAQ:CTSH) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

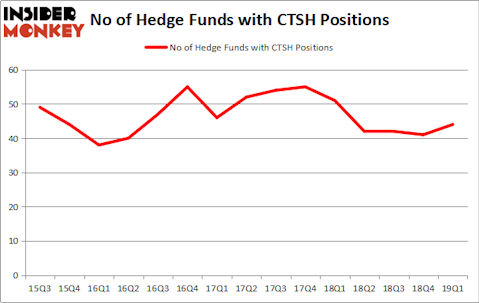

Cognizant Technology Solutions Corp (NASDAQ:CTSH) was in 44 hedge funds’ portfolios at the end of March. CTSH investors should pay attention to an increase in activity from the world’s largest hedge funds recently. There were 41 hedge funds in our database with CTSH holdings at the end of the previous quarter. Our calculations also showed that CTSH isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a lot of signals stock traders put to use to evaluate stocks. Two of the best signals are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the elite fund managers can outpace the S&P 500 by a superb amount (see the details here).

Let’s analyze the latest hedge fund action encompassing Cognizant Technology Solutions Corp (NASDAQ:CTSH).

Hedge fund activity in Cognizant Technology Solutions Corp (NASDAQ:CTSH)

At Q1’s end, a total of 44 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from the previous quarter. On the other hand, there were a total of 51 hedge funds with a bullish position in CTSH a year ago. With hedgies’ capital changing hands, there exists a few key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

Among these funds, Pzena Investment Management held the most valuable stake in Cognizant Technology Solutions Corp (NASDAQ:CTSH), which was worth $553.2 million at the end of the first quarter. On the second spot was AQR Capital Management which amassed $341.4 million worth of shares. Moreover, GLG Partners, Two Sigma Advisors, and Renaissance Technologies were also bullish on Cognizant Technology Solutions Corp (NASDAQ:CTSH), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds were breaking ground themselves. Element Capital Management, managed by Jeffrey Talpins, established the most valuable position in Cognizant Technology Solutions Corp (NASDAQ:CTSH). Element Capital Management had $27.3 million invested in the company at the end of the quarter. Vikas Lunia’s Lunia Capital also made a $9 million investment in the stock during the quarter. The other funds with new positions in the stock are James Dondero’s Highland Capital Management, Tor Minesuk’s Mondrian Capital, and Israel Englander’s Millennium Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Cognizant Technology Solutions Corp (NASDAQ:CTSH) but similarly valued. These stocks are Baxter International Inc. (NYSE:BAX), TC Energy Corporation (NYSE:TRP), Target Corporation (NYSE:TGT), and Aon plc (NYSE:AON). This group of stocks’ market caps are similar to CTSH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BAX | 30 | 3088339 | -6 |

| TRP | 12 | 250653 | -3 |

| TGT | 50 | 1392603 | 10 |

| AON | 39 | 2337303 | -1 |

| Average | 32.75 | 1767225 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.75 hedge funds with bullish positions and the average amount invested in these stocks was $1767 million. That figure was $2375 million in CTSH’s case. Target Corporation (NYSE:TGT) is the most popular stock in this table. On the other hand TC Energy Corporation (NYSE:TRP) is the least popular one with only 12 bullish hedge fund positions. Cognizant Technology Solutions Corp (NASDAQ:CTSH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately CTSH wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CTSH were disappointed as the stock returned -13.6% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.