Is CareDx, Inc. (NASDAQ:CDNA) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

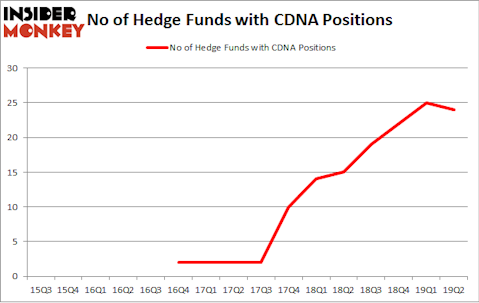

Is CareDx, Inc. (NASDAQ:CDNA) a buy right now? Investors who are in the know are taking a bearish view. The number of long hedge fund positions went down by 1 in recent months. Our calculations also showed that CDNA isn’t among the 30 most popular stocks among hedge funds (see the video below). CDNA was in 24 hedge funds’ portfolios at the end of June. There were 25 hedge funds in our database with CDNA holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the fresh hedge fund action surrounding CareDx, Inc. (NASDAQ:CDNA).

How are hedge funds trading CareDx, Inc. (NASDAQ:CDNA)?

Heading into the third quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -4% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards CDNA over the last 16 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, OrbiMed Advisors held the most valuable stake in CareDx, Inc. (NASDAQ:CDNA), which was worth $29.8 million at the end of the second quarter. On the second spot was Driehaus Capital which amassed $27.8 million worth of shares. Moreover, Two Sigma Advisors, D E Shaw, and AQR Capital Management were also bullish on CareDx, Inc. (NASDAQ:CDNA), allocating a large percentage of their portfolios to this stock.

Since CareDx, Inc. (NASDAQ:CDNA) has witnessed falling interest from the aggregate hedge fund industry, it’s safe to say that there is a sect of funds who were dropping their positions entirely by the end of the second quarter. Interestingly, Brian Sheehy’s Iszo Capital dumped the largest position of all the hedgies followed by Insider Monkey, valued at about $10.3 million in stock. Josh Goldberg’s fund, G2 Investment Partners Management, also cut its stock, about $1.4 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest was cut by 1 funds by the end of the second quarter.

Let’s go over hedge fund activity in other stocks similar to CareDx, Inc. (NASDAQ:CDNA). These stocks are Tootsie Roll Industries, Inc. (NYSE:TR), Heartland Express, Inc. (NASDAQ:HTLD), Edgewell Personal Care Company (NYSE:EPC), and Rent-A-Center Inc (NASDAQ:RCII). This group of stocks’ market caps are similar to CDNA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TR | 13 | 93488 | -3 |

| HTLD | 13 | 29892 | -1 |

| EPC | 25 | 215610 | 6 |

| RCII | 18 | 415518 | -3 |

| Average | 17.25 | 188627 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $189 million. That figure was $170 million in CDNA’s case. Edgewell Personal Care Company (NYSE:EPC) is the most popular stock in this table. On the other hand Tootsie Roll Industries, Inc. (NYSE:TR) is the least popular one with only 13 bullish hedge fund positions. CareDx, Inc. (NASDAQ:CDNA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CDNA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on CDNA were disappointed as the stock returned -37.2% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.