At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

Sony Corporation (NYSE:SNE) has seen a decrease in enthusiasm from smart money lately. Our calculations also showed that sne isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Mario Gabelli of GAMCO Investors

We’re going to view the latest hedge fund action surrounding Sony Corporation (NYSE:SNE).

How are hedge funds trading Sony Corporation (NYSE:SNE)?

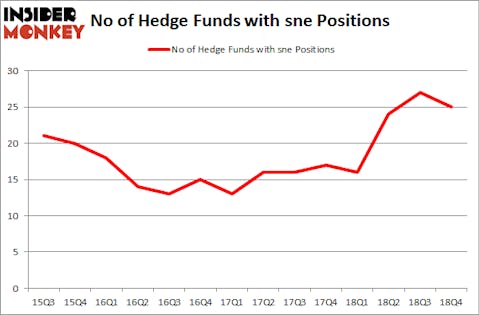

At Q4’s end, a total of 25 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -7% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SNE over the last 14 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

More specifically, GAMCO Investors was the largest shareholder of Sony Corporation (NYSE:SNE), with a stake worth $193.2 million reported as of the end of September. Trailing GAMCO Investors was Renaissance Technologies, which amassed a stake valued at $105.4 million. Soroban Capital Partners, Millennium Management, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Sony Corporation (NYSE:SNE) has witnessed declining sentiment from hedge fund managers, logic holds that there were a few money managers who were dropping their full holdings in the third quarter. Intriguingly, Jonathon Jacobson’s Highfields Capital Management cut the biggest position of all the hedgies watched by Insider Monkey, valued at close to $61.3 million in stock. Fang Zheng’s fund, Keywise Capital Management, also dropped its stock, about $51.2 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 2 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to Sony Corporation (NYSE:SNE). These stocks are The Bank of Nova Scotia (NYSE:BNS), Becton, Dickinson and Company (NYSE:BDX), Biogen Inc. (NASDAQ:BIIB), and Westpac Banking Corporation (NYSE:WBK). This group of stocks’ market valuations match SNE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BNS | 14 | 746136 | 3 |

| BDX | 37 | 908861 | -4 |

| BIIB | 57 | 3239511 | 1 |

| WBK | 10 | 44437 | 4 |

| Average | 29.5 | 1234736 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $1235 million. That figure was $559 million in SNE’s case. Biogen Inc. (NASDAQ:BIIB) is the most popular stock in this table. On the other hand Westpac Banking Corporation (NYSE:WBK) is the least popular one with only 10 bullish hedge fund positions. Sony Corporation (NYSE:SNE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately SNE wasn’t in this group. Hedge funds that bet on SNE were disappointed as the stock lost 4.2% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.