We can judge whether MGM Resorts International (NYSE:MGM) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

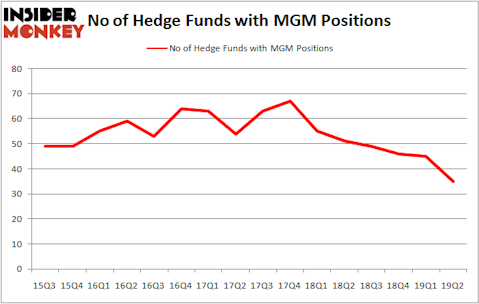

MGM Resorts International (NYSE:MGM) investors should be aware of a decrease in activity from the world’s largest hedge funds in recent months. MGM was in 35 hedge funds’ portfolios at the end of the second quarter of 2019. There were 45 hedge funds in our database with MGM holdings at the end of the previous quarter. Our calculations also showed that MGM isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 25.7% through September 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a look at the new hedge fund action regarding MGM Resorts International (NYSE:MGM).

What does smart money think about MGM Resorts International (NYSE:MGM)?

At Q2’s end, a total of 35 of the hedge funds tracked by Insider Monkey were long this stock, a change of -22% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MGM over the last 16 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

The largest stake in MGM Resorts International (NYSE:MGM) was held by Corvex Capital, which reported holding $587.5 million worth of stock at the end of March. It was followed by Canyon Capital Advisors with a $372.9 million position. Other investors bullish on the company included Two Sigma Advisors, Maverick Capital, and Blue Harbour Group.

Seeing as MGM Resorts International (NYSE:MGM) has faced bearish sentiment from the smart money, logic holds that there is a sect of fund managers who sold off their positions entirely last quarter. It’s worth mentioning that Paul Marshall and Ian Wace’s Marshall Wace LLP said goodbye to the largest stake of the “upper crust” of funds watched by Insider Monkey, valued at an estimated $59.1 million in stock, and Parag Vora’s HG Vora Capital Management was right behind this move, as the fund dumped about $46.2 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest dropped by 10 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to MGM Resorts International (NYSE:MGM). These stocks are New Oriental Education & Tech Group Inc. (NYSE:EDU), KB Financial Group, Inc. (NYSE:KB), Continental Resources, Inc. (NYSE:CLR), and ZTO Express (Cayman) Inc. (NYSE:ZTO). This group of stocks’ market valuations are similar to MGM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EDU | 32 | 849989 | 4 |

| KB | 9 | 56122 | -3 |

| CLR | 34 | 494249 | 3 |

| ZTO | 15 | 325627 | -1 |

| Average | 22.5 | 431497 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $431 million. That figure was $1983 million in MGM’s case. Continental Resources, Inc. (NYSE:CLR) is the most popular stock in this table. On the other hand KB Financial Group, Inc. (NYSE:KB) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks MGM Resorts International (NYSE:MGM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately MGM wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on MGM were disappointed as the stock returned -2.5% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market in Q3.

Disclosure: None. This article was originally published at Insider Monkey.