Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space. Nevertheless, it is also possible to identify cheap large cap stocks by following the footsteps of best performing hedge funds.

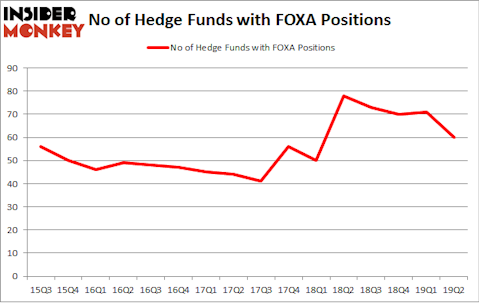

Fox Corporation (NASDAQ:FOXA) has seen a decrease in hedge fund sentiment in recent months. FOXA was in 60 hedge funds’ portfolios at the end of June. There were 71 hedge funds in our database with FOXA holdings at the end of the previous quarter. Our calculations also showed that FOXA isn’t among the 30 most popular stocks among hedge funds.

To most market participants, hedge funds are seen as slow, old investment tools of yesteryear. While there are greater than 8000 funds with their doors open at the moment, Our experts choose to focus on the bigwigs of this club, around 750 funds. These hedge fund managers control most of the hedge fund industry’s total asset base, and by keeping track of their unrivaled picks, Insider Monkey has deciphered a number of investment strategies that have historically surpassed the broader indices. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by around 5 percentage points per annum since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s analyze the new hedge fund action regarding Fox Corporation (NASDAQ:FOXA).

What have hedge funds been doing with Fox Corporation (NASDAQ:FOXA)?

At the end of the second quarter, a total of 60 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -15% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards FOXA over the last 16 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Baupost Group was the largest shareholder of Fox Corporation (NASDAQ:FOXA), with a stake worth $1001.1 million reported as of the end of March. Trailing Baupost Group was Third Point, which amassed a stake valued at $384.7 million. Egerton Capital Limited, Elliott Management, and 3G Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Fox Corporation (NASDAQ:FOXA) has witnessed bearish sentiment from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of money managers that slashed their full holdings by the end of the second quarter. At the top of the heap, Carl Tiedemann and Michael Tiedemann’s TIG Advisors sold off the largest position of all the hedgies tracked by Insider Monkey, comprising an estimated $276.2 million in stock, and Doug Silverman and Alexander Klabin’s Senator Investment Group was right behind this move, as the fund cut about $168.9 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest was cut by 11 funds by the end of the second quarter.

Let’s now review hedge fund activity in other stocks similar to Fox Corporation (NASDAQ:FOXA). These stocks are Fox Corporation (NASDAQ:FOX), TELUS Corporation (NYSE:TU), Interactive Brokers Group, Inc. (NASDAQ:IBKR), and Discovery Inc. (NASDAQ:DISCA). This group of stocks’ market values are similar to FOXA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FOX | 30 | 1020193 | -10 |

| TU | 13 | 327747 | 0 |

| IBKR | 24 | 1002716 | 1 |

| DISCA | 24 | 335380 | -2 |

| Average | 22.75 | 671509 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $672 million. That figure was $3322 million in FOXA’s case. Fox Corporation (NASDAQ:FOX) is the most popular stock in this table. On the other hand TELUS Corporation (NYSE:TU) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Fox Corporation (NASDAQ:FOXA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately FOXA wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FOXA were disappointed as the stock returned -13.3% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks (see the video below) among hedge funds as many of these stocks already outperformed the market in Q3.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.