Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Caterpillar Inc. (NYSE:CAT).

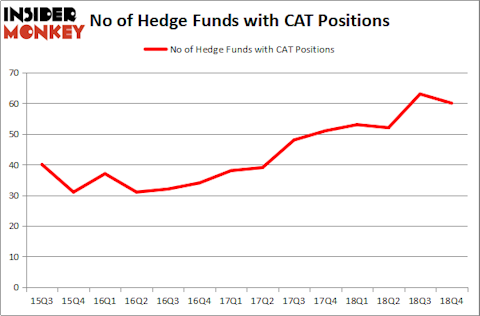

Is Caterpillar Inc. (NYSE:CAT) a healthy stock for your portfolio? Hedge funds are turning less bullish. The number of bullish hedge fund bets fell by 3 in recent months. Our calculations also showed that CAT isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of metrics stock traders employ to value stocks. Some of the less known metrics are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the top picks of the top fund managers can trounce their index-focused peers by a healthy amount (see the details here).

We’re going to review the key hedge fund action regarding Caterpillar Inc. (NYSE:CAT).

How have hedgies been trading Caterpillar Inc. (NYSE:CAT)?

Heading into the first quarter of 2019, a total of 60 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from the second quarter of 2018. By comparison, 53 hedge funds held shares or bullish call options in CAT a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Bill & Melinda Gates Foundation Trust, managed by Michael Larson, holds the number one position in Caterpillar Inc. (NYSE:CAT). Bill & Melinda Gates Foundation Trust has a $1.4309 billion position in the stock, comprising 6.5% of its 13F portfolio. The second largest stake is held by Ken Griffin of Citadel Investment Group, with a $262.8 million position; 0.1% of its 13F portfolio is allocated to the company. Remaining members of the smart money that hold long positions comprise Phill Gross and Robert Atchinson’s Adage Capital Management, Robert Bishop’s Impala Asset Management and Matt Simon (Citadel)’s Ashler Capital.

Due to the fact that Caterpillar Inc. (NYSE:CAT) has faced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there were a few money managers that elected to cut their positions entirely by the end of the third quarter. At the top of the heap, Aaron Cowen’s Suvretta Capital Management sold off the biggest stake of the 700 funds monitored by Insider Monkey, valued at close to $193.9 million in call options, and Brandon Haley’s Holocene Advisors was right behind this move, as the fund dumped about $106.7 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 3 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Caterpillar Inc. (NYSE:CAT). These stocks are Lockheed Martin Corporation (NYSE:LMT), Lowe’s Companies, Inc. (NYSE:LOW), U.S. Bancorp (NYSE:USB), and British American Tobacco plc (NYSEAMEX:BTI). This group of stocks’ market values resemble CAT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LMT | 42 | 1269393 | 6 |

| LOW | 53 | 4173120 | -4 |

| USB | 41 | 6538818 | 2 |

| BTI | 10 | 191500 | -5 |

| Average | 36.5 | 3043208 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.5 hedge funds with bullish positions and the average amount invested in these stocks was $3043 million. That figure was $3130 million in CAT’s case. Lowe’s Companies, Inc. (NYSE:LOW) is the most popular stock in this table. On the other hand British American Tobacco plc (NYSEAMEX:BTI) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Caterpillar Inc. (NYSE:CAT) is more popular among hedge funds, however some hedge funds were turning bearish at the end of last quarter and they were proven right. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately CAT wasn’t in this group. Hedge funds that bet on CAT were disappointed as the stock returned 5.1% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.