Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4.5 years and analyze what the smart money thinks of Canadian Natural Resources Limited (NYSE:CNQ) based on that data and determine whether they were really smart about the stock.

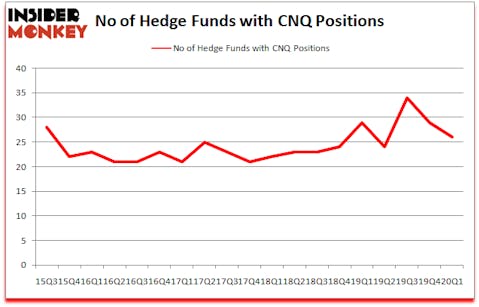

Is Canadian Natural Resources Limited (NYSE:CNQ) a buy here? Investors who are in the know were turning less bullish. The number of bullish hedge fund bets were trimmed by 3 recently. Our calculations also showed that CNQ isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). CNQ was in 26 hedge funds’ portfolios at the end of the first quarter of 2020. There were 29 hedge funds in our database with CNQ holdings at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Today there are several metrics stock traders use to assess publicly traded companies. A couple of the most under-the-radar metrics are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the top fund managers can outclass the market by a very impressive amount (see the details here).

Ray Dalio of Bridgewater Associates

At Insider Monkey we scour multiple sources to uncover the next great investment idea. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than tripled this year. We are trying to identify other EV revolution winners, so we are checking out this tiny lithium stock. With all of this in mind let’s take a glance at the latest hedge fund action encompassing Canadian Natural Resources Limited (NYSE:CNQ).

How are hedge funds trading Canadian Natural Resources Limited (NYSE:CNQ)?

Heading into the second quarter of 2020, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -10% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CNQ over the last 18 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, GMT Capital held the most valuable stake in Canadian Natural Resources Limited (NYSE:CNQ), which was worth $26.2 million at the end of the third quarter. On the second spot was Point72 Asset Management which amassed $16.6 million worth of shares. Two Sigma Advisors, Galibier Capital Management, and Bridgewater Associates were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Elm Ridge Capital allocated the biggest weight to Canadian Natural Resources Limited (NYSE:CNQ), around 9.93% of its 13F portfolio. Galibier Capital Management is also relatively very bullish on the stock, designating 3.75 percent of its 13F equity portfolio to CNQ.

Because Canadian Natural Resources Limited (NYSE:CNQ) has witnessed declining sentiment from hedge fund managers, logic holds that there exists a select few hedgies who were dropping their entire stakes by the end of the first quarter. At the top of the heap, Vince Maddi and Shawn Brennan’s SIR Capital Management said goodbye to the largest stake of the “upper crust” of funds followed by Insider Monkey, comprising close to $21.1 million in stock. Alex Snow’s fund, Lansdowne Partners, also cut its stock, about $20.2 million worth. These bearish behaviors are interesting, as total hedge fund interest fell by 3 funds by the end of the first quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Canadian Natural Resources Limited (NYSE:CNQ) but similarly valued. These stocks are Yum China Holdings, Inc. (NYSE:YUMC), Copart, Inc. (NASDAQ:CPRT), FleetCor Technologies, Inc. (NYSE:FLT), and Incyte Corporation (NASDAQ:INCY). All of these stocks’ market caps match CNQ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| YUMC | 24 | 721412 | -5 |

| CPRT | 48 | 732842 | 2 |

| FLT | 51 | 1655053 | 7 |

| INCY | 40 | 3325488 | -6 |

| Average | 40.75 | 1608699 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40.75 hedge funds with bullish positions and the average amount invested in these stocks was $1609 million. That figure was $107 million in CNQ’s case. FleetCor Technologies, Inc. (NYSE:FLT) is the most popular stock in this table. On the other hand Yum China Holdings, Inc. (NYSE:YUMC) is the least popular one with only 24 bullish hedge fund positions. Canadian Natural Resources Limited (NYSE:CNQ) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th and still beat the market by 15.5 percentage points. A small number of hedge funds were also right about betting on CNQ as the stock returned 30.7% during the second quarter and outperformed the market by an even larger margin.

Follow Canadian Natural Resources Ltd (NYSE:CNQ)

Follow Canadian Natural Resources Ltd (NYSE:CNQ)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.