Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ recent losses in Facebook. Let’s take a closer look at what the funds we track think about Union Pacific Corporation (NYSE:UNP) in this article.

Is Union Pacific Corporation (NYSE:UNP) going to take off soon? Prominent investors are taking a bullish view. The number of bullish hedge fund positions advanced by 2 recently. Our calculations also showed that UNP isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s analyze the latest hedge fund action surrounding Union Pacific Corporation (NYSE:UNP).

What have hedge funds been doing with Union Pacific Corporation (NYSE:UNP)?

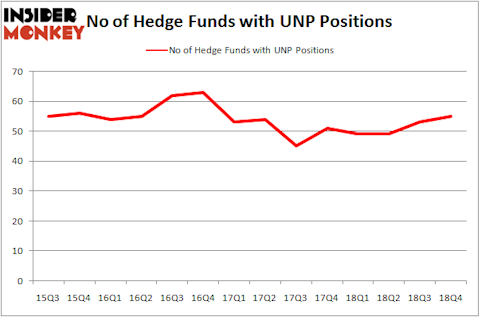

At the end of the fourth quarter, a total of 55 of the hedge funds tracked by Insider Monkey were long this stock, a change of 4% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in UNP over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Egerton Capital Limited, managed by John Armitage, holds the biggest position in Union Pacific Corporation (NYSE:UNP). Egerton Capital Limited has a $1.0232 billion position in the stock, comprising 8.5% of its 13F portfolio. The second largest stake is held by Soroban Capital Partners, led by Eric W. Mandelblatt and Gaurav Kapadia, holding a $539.4 million position; the fund has 11.3% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions contain Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Ken Griffin’s Citadel Investment Group and Israel Englander’s Millennium Management.

As aggregate interest increased, key money managers were leading the bulls’ herd. Ashler Capital, managed by Matt Simon (Citadel), initiated the largest position in Union Pacific Corporation (NYSE:UNP). Ashler Capital had $91.1 million invested in the company at the end of the quarter. Andrew Immerman and Jeremy Schiffman’s Palestra Capital Management also initiated a $66 million position during the quarter. The following funds were also among the new UNP investors: Lee Hicks and Jan Koerner’s Park Presidio Capital, Benjamin A. Smith’s Laurion Capital Management, and Brandon Haley’s Holocene Advisors.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Union Pacific Corporation (NYSE:UNP) but similarly valued. These stocks are Paypal Holdings Inc (NASDAQ:PYPL), Royal Bank of Canada (NYSE:RY), Honeywell International Inc. (NYSE:HON), and AstraZeneca plc (NYSE:AZN). This group of stocks’ market valuations match UNP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PYPL | 103 | 4377517 | 6 |

| RY | 14 | 655003 | -3 |

| HON | 57 | 2830615 | 10 |

| AZN | 21 | 1348061 | -5 |

| Average | 48.75 | 2302799 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 48.75 hedge funds with bullish positions and the average amount invested in these stocks was $2303 million. That figure was $3330 million in UNP’s case. Paypal Holdings Inc (NASDAQ:PYPL) is the most popular stock in this table. On the other hand Royal Bank of Canada (NYSE:RY) is the least popular one with only 14 bullish hedge fund positions. Union Pacific Corporation (NYSE:UNP) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on UNP as the stock returned 20% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.