At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards BrightSphere Investment Group Inc (NYSE:BSIG) at the end of the first quarter and determine whether the smart money was really smart about this stock.

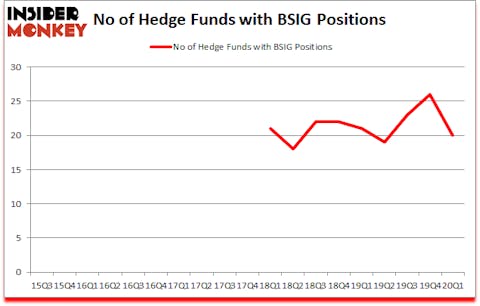

BrightSphere Investment Group Inc (NYSE:BSIG) investors should be aware of a decrease in activity from the world’s largest hedge funds lately. BSIG was in 20 hedge funds’ portfolios at the end of the first quarter of 2020. There were 26 hedge funds in our database with BSIG positions at the end of the previous quarter. Our calculations also showed that BSIG isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most investors, hedge funds are perceived as worthless, old financial tools of years past. While there are more than 8000 funds trading at the moment, Our experts hone in on the moguls of this group, approximately 850 funds. Most estimates calculate that this group of people command the lion’s share of the hedge fund industry’s total asset base, and by tracking their unrivaled picks, Insider Monkey has unearthed several investment strategies that have historically outpaced the broader indices. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Cannabis stocks are roaring back in 2020, so we are checking out this under-the-radar stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. With all of this in mind we’re going to take a look at the latest hedge fund action encompassing BrightSphere Investment Group Inc (NYSE:BSIG).

What does smart money think about BrightSphere Investment Group Inc (NYSE:BSIG)?

Heading into the second quarter of 2020, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -23% from one quarter earlier. By comparison, 21 hedge funds held shares or bullish call options in BSIG a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Paulson & Co, managed by John Paulson, holds the largest position in BrightSphere Investment Group Inc (NYSE:BSIG). Paulson & Co has a $127.8 million position in the stock, comprising 4.9% of its 13F portfolio. Sitting at the No. 2 spot is Mangrove Partners, led by Nathaniel August, holding a $27.1 million position; 3.7% of its 13F portfolio is allocated to the company. Some other members of the smart money with similar optimism contain Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, John Overdeck and David Siegel’s Two Sigma Advisors and Steve Cohen’s Point72 Asset Management. In terms of the portfolio weights assigned to each position Paulson & Co allocated the biggest weight to BrightSphere Investment Group Inc (NYSE:BSIG), around 4.88% of its 13F portfolio. Mangrove Partners is also relatively very bullish on the stock, setting aside 3.74 percent of its 13F equity portfolio to BSIG.

Seeing as BrightSphere Investment Group Inc (NYSE:BSIG) has faced a decline in interest from hedge fund managers, we can see that there were a few money managers that elected to cut their positions entirely heading into Q4. Intriguingly, Lee Ainslie’s Maverick Capital sold off the largest position of the 750 funds watched by Insider Monkey, valued at close to $4.8 million in stock, and Michael Gelband’s ExodusPoint Capital was right behind this move, as the fund sold off about $0.9 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 6 funds heading into Q4.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as BrightSphere Investment Group Inc (NYSE:BSIG) but similarly valued. We will take a look at Usa Compression Partners LP (NYSE:USAC), Lakeland Bancorp, Inc. (NASDAQ:LBAI), Arbor Realty Trust, Inc. (NYSE:ABR), and LendingClub Corp (NYSE:LC). This group of stocks’ market valuations match BSIG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| USAC | 5 | 7663 | -3 |

| LBAI | 10 | 21066 | 0 |

| ABR | 14 | 37504 | -7 |

| LC | 7 | 2595 | -1 |

| Average | 9 | 17207 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $17 million. That figure was $185 million in BSIG’s case. Arbor Realty Trust, Inc. (NYSE:ABR) is the most popular stock in this table. On the other hand Usa Compression Partners LP (NYSE:USAC) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks BrightSphere Investment Group Inc (NYSE:BSIG) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 18.6% in 2020 through July 27th but still managed to beat the market by 17.1 percentage points. Hedge funds were also right about betting on BSIG as the stock returned 118.1% since Q1 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Acadian Asset Management Inc. (NYSE:AAMI)

Follow Acadian Asset Management Inc. (NYSE:AAMI)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.